Sugarcane

Industry Strategic Science and Technology Program

Sugarcane Industry Profile

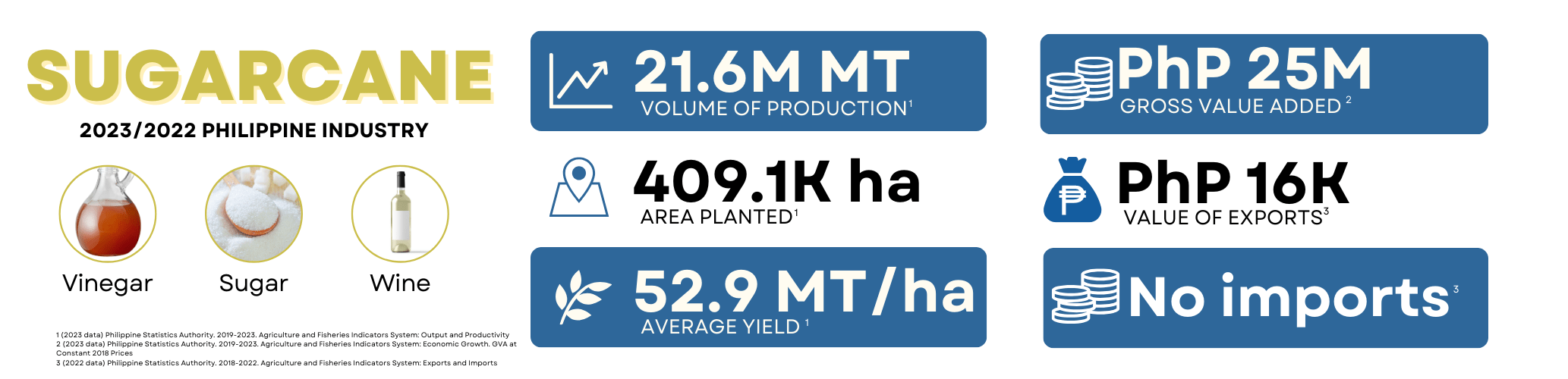

Sugarcane is one of the top five largest crop by value following rice, banana, corn, and coconut.

The sugarcane industry contributes around PHP 76 billion annually to the Philippine economy. Currently, sugarcane is cultivated in 398,478 hectares, with Negros island accounting for 57 percent; followed by Mindanao with 21 percent; Luzon, 11 percent; Panay, 8 percent; and Eastern Visayas, 3 percent (SRA, 2022).

The Philippines has about 88,000 sugarcane farmers. Of these, 84 percent have landholdings less than five hectares. There are 27 operating millers of raw sugarcane with a combined crushing capacity of 200,00 metric tons of cane per day and 12 refineries with a combined capacity of 144,500 bags of refined sugar per day operating at 70% milling capacity. Close to 700,000 Filipinos are directly employed in sugarcane production and it has around 5-6 million more dependents (SRA 2022).

Molasses, which is a byproduct of sugar processing, is the primary feedstock for Philippine bioethanol. The country has currently 13 operating bioethanol distilleries with a combined capacity of 425.5 million liters. On the other hand, bagasse and sugarcane trash are the raw materials of the Biomass power plants of 12 sugar mills and 2 distilleries with a total installed capacity of 366 MW.

Problems in the Industry

Some of the key constraints identified include:

- Decline in sugarcane area, particularly in areas outside Negros island that pull down the national average

- Climate variability: too much drought or too much rain adversely affect production

- Low cane yield per hectare [56-60 tons cane per hectare (TC/ha)] compared to other sugar producing countries

- Factors that limit productivity such as (1) soil acidity, (2) low soil organic matter content, (3) soil erosion, (4) limited access to new high yielding varieties, (5) high cost of farm and mill production inputs, (6) inappropriate farm mechanization provision, (7) low mill efficiency

Data Source: Philippine Statistics Authority. 1990-2022

Data Source: Philippine Statistics Authority. 1990-2022

Data Source: Philippine Statistics Authority. 1990-2022

Data Source: Philippine Statistics Authority. 1990-2022

Data Source: Philippine Statistics Authority. 1990-2022

Sugarcane Policies

| Policy Type | Policy Number | Policy Year | Congress | Policy Title | Policy Description | Policy Objective | Policy Link | Commodity | Classification | info_encoder_stamp | info_date_stamp | info_quashing_remarks | filepath |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bill | House Bill No. 835 | 2022 | 19th | An Act Strengthening The Sugarcane Industry, Increasing Its Annual Supplemental Budget, And For Other Purposes | The Department of Budget and Management (DBM) is hereby mandated to include annually, starting the year 2022, an initial aggregate amount of Five billion pesos (P5,000,000,000.00) in the President's program of expenditures for submission to Congress and allocated, as follows: (a)Fifteen percent (15%) for grants to block farms under the Block Farm Program; (b)Fifteen percent (15%) for socialized credit under the Farm Support and Farm Mechanization Programs; (c) Fifteen percent (15%) for research and development, capability building and technology transfer activities under Research and Development, Extension Services, Human Resources Development, and Farm Support Programs; (d) Five percent (5%) for scholarship grants to be provided under paragraph (b) of Section 6 of RA10659 otherwise known as the "Sugarcane Industry Development Act of 2015”, Human Resources Development; and (e) Fifty percent (50%) for infrastructure support programs. In the identification and prioritization of specific programs and projects, the Sugar Regulatory Administration (SRA) shall conduct prior consultation with representatives of block farms, sugarcane farmers and workers, sugar millers, refiners, bioenergy producers, and producers of other products derived from sugarcane and its byproducts. The Department shall issue the necessary guidelines for this purpose. For the current year, the DBM shall include in a supplemental budget, that may be formulated, the amount of Five billion Pesos (P5,OOO,OOO,OOO.OO) and following the allocation prescribed in this section. | For purposes of this Act, this Program is the consolidation of small farms including farms of agrarian reform beneficiaries, as one larger farm, with a minimum area of thirty (30) hectares within a two-kilometer radius, to take advantage of the economies of scale in the production of sugarcane, such that the activities in the small farms are aligned and implemented to ensure the efficient use of farm machineries and equipment, deployment of workers, volume purchase of inputs, financing, and other operational advantages, as well as recognition by sugar mills, government financial institutions, private investors, but the ownership of each small farm remains with the landowners. The Sugar Regulatory Administration (SRA), the Department of Agriculture (DA), the Department of Agrarian Reform (DAR) and other concerned government agencies shall provide common service facilities, such as farm machineries and implements, grants or start-up funding for the needed production inputs, technology adoption, livelihood and skills training and other development activities for the block farm and its members, and other support activities that may be identified. | https://docs.congress.hrep.online/legisdocs/basic_19/HB00835.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Resolution | Senate Resolution No. 300 | 2020 | 18th | Resolution Urging The Appropriate Senate Committee To Conduct An Inquiry, In Aid Of Legislation, Into The Continued Incapacity Of The Sugar Regulatory Administration (SRA) In Strengthening The Sugar Industry | An almost unanimous clamor for change in the SRA from the sugar industry stakeholders ranging from the major sugar planters to the marginal farmers and farm workers, alleging that of the much-reduced five-hundred million pesos (P500,000,000.00) budget, a mere fifty-five million pesos (P55,000,000.00) for farm-to-mill roads was actually disbursed; Urging the appropriate Senate committee to conduct an inquiry, in aid of legislation, into the continued incapacity of the Sugar Regulatory Administration (SRA) in strengthening the sugar industry. | The resolution seeks to conduct an inquiry into the continued incapacity of the SRA in strengthening the sugar industry. | http://legacy.senate.gov.ph/lisdata/3220829054!.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 11346 | 2019 | 17th | An Act Increasing the Excise Tax on Tobacco Products, Imposing Excise Tax on Heated Tobacco Products and Vapor Products, Increasing the Penalties for Violations of Provisions on Articles Subject to Excise Tax, and Earmarking a Portion of the Total Excise Tax Collection From Sugar-Sweetened Beverages, Alcohol, Tobacco, Heated Tobacco and Vapor Products for Universal Health Care, Amending For This Purpose Sections 144, 145, 146, 147, 152, 164, 260, 262, 263, 265, 288, AND 289, Repealing Section 288(B) AND 288(C), and Creating New Sections 263-A 265-B, and 288-A of the New National Internal Revenue Code of 1997, As Amended By Republic Act No. 10963, and For Other Purposes | Revenues from Excise Tax on Sugar-Sweetened Beverages from RA 10963 - The provisions of existing laws to the contrary notwithstanding, fifty percent (50%) of the total revenues collected fromn the excise tax on sugar-sweetend beverages shall be allocated and used exclusively in the following manner: (1) Eighty percent (80%) to the Philippine Health Insurance Corporation (PhilHealth) for the implementation of Republic Act No. 11223, otherwise known as the 'Universal Health Care Act' of 2019; and (2) Twenty percent (20%) shall be allocated antionwide, based on political and distrcit subdivisions for medical assistance, the Health Facilties Enhncement Program (HFEP), the annual requirements of which shall be determined by the Department of Health (DOH). | The law seeks to provide additional funding source for the Universal Health Care Law in order to further reduce the funding gap. An equally important objective of the billl is to discourage excessive consumption of alcohol and cigarette products especially among the youth. | https://www.senate.gov.ph/republic_acts/ra%2011346.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 997 | 2019 | 18th | An Act Strengthening the Sugarcane Industry, Increasing its Annual Supplemental Budget, and For Other Purposes | The Department of Budget and Management (DBM) is hereby mandated to include annually, starting the year 2019, an initial aggregate amount of Five billion pesos (P5,000,000,000.00) in the President's program of expenditures for submission to Congress and allocated, as follows: (a) Fifteen percent (15%) for grants to block farms under the Block Farm Program; (b) Fifteen percent (15%) for socialized credit under the Farm Support and Farm Mechanization Programs; (c) Fifteen percent (15%) for research and development, capability building and technology transfer activities under Research and Development, Extension Services, Human Resources Development, and Farm Support Programs; (d) Five percent (5%) for scholarship grants to be provided under paragraph (b) of Section 6 of otherwise known as the "Sugarcane Industry Development Act of 2015, Human Resources Development; and RA10659 (e) Fifty percent (50%) for infrastructure support programs. | The bill seeks to allot a supplemental budget to strengthen the Sugarcane Industry. | http://www.congress.gov.ph/legisdocs/basic_18/HB00997.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 2971 | 2019 | 18th | An Act Amending Section 11 of RA 10659 or the Sugar Development Act of 2015 or "S.I.D.A Proportionality and Protection Act of 2019" | Revision of Section 9 of RA 10659: "The SRA, in the exercise of its regulatory authority, may block, set limits on, or otherwise regulate the importation of sugar and its by-products into the Philippines, unless domestic supply cannot meet domestic demand. At no instance may importation or release from customs of imported sugar be affected without a written authorization from the SRA. The Bureau of customs (BOC) shall require importers or consignees to secure from the SRA the classification of the imported sugar prior to its release." Amendment of Section 11: "The aforementioned program of expenditures shall be allocated among the mill districts in proportion to their sugar production levels in the previous year. The SRa shall modify or adjust its policies, regulations, and roadmaps consistent with such proportional allocation of the foregoing expenditures." "In the identification and prioritization of specific programs and projects, opportunities for which shall also be proportionally allocated among the mill districts in proportion to sugar production levels,... the Department shall issue the necessary guidelines for this purpose" Mandate of SRA: The SRA is mandated to issue new implementing rules, regulations, circulars, or revise such existing issuances consistent with this amendment of the SIDA of 2015. | This bill seeks to introduce two (2) new mechanisms in the SIDA's policy: 1) proportionate allocation of expenditures based on productivity; and 2) supervisory powers of the Sugar Regulatory Administration (SRA) for the importation of sugar. | http://www.congress.gov.ph/legisdocs/basic_18/HB02971.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | (1) House Bill No. 2404 (2) House Bill No. 6618 | 2019 | 18th | An Act Regulating The Airing Of Advertisements Of Sugar Sweetened Beverages And Providing Penalties For Violation Thereof | It shall be unlawful for any person or entity operating a radio, television andcable television to air advertisements of sugar sweetened beverages betwwin 2:30 pm to 7:30 pm form Mondays to Fridays and between 7:30 am to 7:30 pm during Saturdays and Sundays. | The bills seek to regulate the airing of advertisements of sugar sweetened beverages to lessen the exposure of children to sugary drinks. | http://www.congress.gov.ph/legisdocs/basic_18/HB02404.pdf http://www.congress.gov.ph/legisdocs/basic_18/HB06118.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | (1) House Bill No. 2722 (2) House Bill No. 5380 | 2019 | 18th | An Act Further Strengthening The Social Amelioration Program In The Sugar Industry, Amending For This Purpose Certain Provisions Of R.A. No. 6982 Entitled, An Act Strengthening The Social Amelioration Program In The Sugar Industry, Providing The Mechanics For Its Implementation, And For Other Purposes | Sec 7. Effective on sugar crop year 2019-2020, a lien of ten pesos (P10.00) per picul of sugar shall be imposed on the gross production of sugar to primarily argument the income of sugar workers, and to finance social and economic programs to improve theri livelihood and well-being: provided that there shall be an automatic additional lien of not exceeding one peso (P1.00) for every two (2) years for the succeeding ten (10) years from the effectivity of this Act, taking into consideration the circumstances affecting the cost of production. Sec 9. Undisputed Cash Bonus - Any undistributed amount shall be placed in a special fund tobe administered by the DTC; fifty percent of said fund shall be alloted to finance educational programs for the sugar farmers and their dependents | This measure seeks to amend RA 6982 or the Social Amerioration Law by modifying certain provisions in the lw that will address the need for educational, health and medical benefits to our sugar farmers. | http://www.congress.gov.ph/legisdocs/basic_18/HB02722.pdf http://www.congress.gov.ph/legisdocs/basic_18/HB05380.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Resolution | Adopted Senate Resolution No. 22 | 2019 | 18th | Resolution Urging The Executive Department Not To Pursue The Planned Liberalization Of The Sugar Industry With The End In View Of Safeguarding The Welfare Of Sugar Farmers And Industry Workers In More Than Twenty (20) Provinces In The Country | The deregulated entry of subsidized sugar into the Philippine market will be disastrous to our sugar industry, which contributes an estimated P96 billion to the Gross Domestic Product, particularly to 84,000 farmers— mostly small farmers and agrarian reform beneficiaries, with each farmer tills less than a hectare of sugar farmland—and 720,000 industry workers directly affecting almost a million famihes or 5 milhon individuals. It is hereby resolved by the Senate, To urge the Executive Department not to pursue the planned liberalization of the sugar industry with the end in view of safeguarding the welfare of sugar farmers and industry workers in more thn twenty (20) provinces in the country. | The resolution aims to urge the executive department not to pursue the planned liberalization of the sugar industry. | http://legacy.senate.gov.ph/18th_congress/resolutions/resno22.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Resolution | Senate Resoultion No. 156 | 2019 | 18th | Resolution Urging The Department Of Agriculture And The Sugar Regulatory Administration To Mitigate The Current Situation Of The Philippine Sugar Industry By Converting The United States f America’s Tariff-Rate Quota (TRQ) Allocations For Local Industrial Consumers | If we convert the US TRQ which is equivalent to One Hundred Five Thousand (105,000) metric tons of sugar for our local industrial consumers we can satisfy the demand of our local manufacturers and processors and we may no longer import for their needs. It is hereby resolved, to urge the Department of Agriculture and the Sugar Regulatory Administration to mitigate the current situation of the Philippine Sugar Industry by converting the United States of America's Tariff-Rate Quota (TRQ) allocations of sugar for local industrial consumers. | The resolution seeks to urge the DA and SRA to convert the USA TRQ allocations for local industrial consumers. | http://legacy.senate.gov.ph/lisdata/3166128506!.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Resolution | Senate Resolution No. 56 | 2019 | 18th | Resolution Directing The Senate Committee On Agriculture And Other Appropriate Senate Committees To Conduct An Inquiry, In Aid Of Legislation, On The Status Of The Implementation Of The Sugar Industry Development Act Of 2015, Particularly On The Reported Failure Of The Department Of Budget And Management To Include The Mandatory Appropriation Of Two Billion Pesos In The General Appropriations Act And The Non-Implementation Of The Sugar Regulatory Administrator Of The Programs Under SIDA | In a news report, the SIDA fund has been slashed to 67 million for the year 2020 from the original 2 billion pesos mandated appropriation; in the same news report, the DBM was quoted as stating that the budget cut was due to underspending or underutilization by the SRA; The implementation of SIDA falls squarely on the shoulders of the SRA Administrator as the head of the agency and as the accountable officer for the implementation of the programs under SIDA, the SRA Administrator must adequately explain the non-implementation of the provisions of SIDA. It is hereby resolved, to direct the Senate Committee on Agriculture and other appropriate Senate Committees to conduct an inquiry, in aid of legislation, on the implementation of the Sugar Industry Development Act of 2015, particularly on the reported failure of the Department of Budget and Management to include the mandatory appropriation of two billion pesos in the General Appropriations Act and the non-implementation of the Sugar Regulatory Administrator of the programs under SIDA. | The resolution seeks to investigate the reported non-implementation of the Sugar Regulatory Administrator of the programs under SIDA. | http://legacy.senate.gov.ph/lisdata/3082127664!.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | Senate Bill No. 1808 | 2018 | 17th | An Act to Remove Or Exclude Refined Sugar From The List Of Products Covered By Mandatory Food Fortification, Amending For This Purpose Republic Act No. 8976, Otherwise Known As The Food Fortification Act Of 2000 | Sections 1, 2, and 3 of the "Philippine Food Fortification Act of 2000" is hereby amended to delete refined sugar Mutatis mutandis. | This bill seeks to amend RA 8976 by removing or excluding refined sugar from the list of products covered by mandatory food fortification. | https://www.senate.gov.ph/lisdata/2786724176!.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Administrative Order | Administrative Order No. 13 | 2018 | 18th | Removing Non-Tariff Barriers and Streamlining Administrative Procedures on the Importation of Agricultural Products | Removal of Non-Tariff Barriers and Streamlining of Administrative Procedures. - Subject to conditions imposed by applicable laws and consistent with their respective legal mandates, the National Food Authority (NFA), SRA, and DA, in coordination with the Department of Trade and Industry (DTI), shall undertake immediate measures to remove administrative constraints and other non-tariff barriers on the importation of agricultural products, such as but not limited to the following: (a) Streamline procedures and requirements in the accreditation of importers and minimize the processing time of applications for importation; (b) Exempt traders that are already accredited from registration requirements; (c) Facilitate importation of certain agricultural products beyond their authorized MAV and, where applicable, reduce or remove fees relative thereto in order to ensure their sufficient supply in the domestic market at more affordable prices; (d) Liberalize issuance of permits and accreditation of traders who want to import rice to break monopoly; and (e) As may be necessary, temporarily allow direct importation by sugar-using industries to lower their input cost, subject to reasonable regulations. | It is the policy of the State to develop, adopt and promulgate measures to stabilize prices at reasonable levels. | https://www.officialgazette.gov.ph/downloads/2018/09sep/20180921-AO-13-RRD.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 10963 | 2017 | 17th | Tax Reform for Acceleration and Inclusion (TRAIN) | Under the TRAIN law, a P6-per-liter excise tax is imposed on beverages using caloric and noncaloric sweeteners and P12 per liter on beverages using high-fructose corn syrup (HFCS). On the other hand, for imported goods, the Bureau of Customs (BOC) applied a value-added tax (VAT) of 12 percent, while there is no tax on goods worth less than P10,000. Thirty percent of the yearly incremental revenues from TRAIN shall be automatically appropriated programs under RA 10659, also known as "Sugarcane Industry Development Act of 2015", among others. | The law aims to generate revenue to achieve the 2022 and 2040 vision of the Duterte administration, namely, to eradicate extreme poverty, to create inclusive institutions that will offer equal opportunities to all, and to achieve higher income country status. It also aims to make the tax system simpler, fairer and more efficient. | https://www.officialgazette.gov.ph/downloads/2017/12dec/20171219-RA-10963-RRD.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 10864 | 2016 | 16th | An Act Defining Raw Sugar or Raw Cane Sugar, Amending Section 109(A) and (F) of the National Internal Revenue Code of 1997, As Amended, and For Other Purposes | Section 109. Exempt Transactions - exempt from VAT (A) "Sale or importation of agricultural and marine food productis in their original state, livestock and poultry of a kind generally use as, or yielding or producing foods for human consumption; and breeding stock and geentic materials therefor. Products classified under this paragraph shall be considered in their original state even if they have undergone the simple processes of preparation or preservation for the market, such as freezingm drying, salting, broiling, roasting, smoking, or stripping. Polished and/or husked rice, corn grits, raw sugar or raw can sugar and molasses, ordinary salt and copra shall be considered in their original state; For this purpose, notwithstanding process/es involved in its production, raw sugar or raw cane sugar means sugar whose content of sucrose by weight, in the dry state, corresponds to a polarimeter reading of less than 99.5 degrees." (F) Services by agricultural contract growers and milling for others of palay into rice, corn into grits, and sugar cane into raw sugar or raw cane sugar. | The law seeks to amend the National Internal Revenue Code of 1997, as amended, by clarifying the definition and providing for the technical meaning of "Raw Cane Sugar" in order to reflect the true intent of the legislature in exempting from value-added tax (VAT) the sale of "Raw Cane Sugar." | https://www.sra.gov.ph/wp-content/uploads/2016/06/REPUBLIC-ACT-10864-AN-ACT-DEFINING-RAW-SUGAR0001.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 10845 | 2016 | 26th | An Act Declaring Large-Scale Agricultural Smuggling as Economic Sabotage, Prescribing Penalties Therefor and For Other Purposes | SEC. 3. Large-Scale Agricultural Smuggling as Economic Sabotage. – The crime of large-scale agricultural smuggling as economic sabotage, involving sugar, corn, pork, poultry, garlic, onion, carrots, fish, and cruciferous vegetables, in its raw state, or which have undergone the simple processes of preparation or preservation for the market, with a minimum amount of one million pesos (P1,000,000.00), or rice, with a minimum amount of ten million pesos (P10,000,000.00), as valued by the Bureau of Customs (BOC). | The law aims to impose higher sanctions for large-scale smuggling of agricultural products, as a self-preservation measure to shield itself from the manipulative scheme of economic saboteurs, and to protect the livelihood of our farmers and to ensure their economic well-being. | https://www.officialgazette.gov.ph/2016/05/23/republic-act-no-10845/ | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 10659 | 2015 | 16th | An Act Promoting and Supporting the Competitiveness of the Sugarcane Industry and For Other Purposes or "Sugarcane Industry Development Act of 2015" | Under this Act, the state shall: (a) establish productivity improvement programs such as block farm program, farm support program, and farm mechanization program; (b) provide the needed infrastructure support such as transport infrastructure, farm-to-mill roads, adn irrigation; (c) enhance R&D of other products derived from sugar, sugarcane, and their by-products in coordination with the Department of Science and Technology (DOST); (d) provide human resource development (Humar Resources Development master plan in partnership with DOLE, CHED, TESDA, PRC, and private sector) and extension services; and (e) provide financial assistance to small farmers - SRA, in the exercise of its regulatory authority, shall classify imported sugar according to its appropriate classification when imported at a time that domestic production is sufficient to meet domestic sugar requirements. The Bureau of customs (BOC) shall require importers or consignees to secure from the SRA the classification of the imported sugar prior to its release - VAT Zero-rated shall be imposed on refined sugar withdrawn from warehouses for actual physical export to the world market - DBM is mandated to include annually, starting 2016, an initial aggregate amount of two billion pesos (PhP 2,000,000,000.00) to SIDA. | The law aims to to promote the competitiveness of the sugarcane industry and maximize the utilization of sugarcane resources, and improve the incomes of farmers and farm workers, through improved productivity, product diversification, job generation, and increased 'efficiency of sugar mills. | https://www.senate.gov.ph/republic_acts/ra%2010659.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | Senate Bill No. 2332 | 2014 | 16th | An Act Further Strengthening The Social Amelioration Program In The Sugar Industry, Amending For This Purpose Certain Provisions Of R.A. No. 6982 Entitled, An Act Strengthening The Social Amelioration Program In The Sugar Industry, Providing The Mechanics For Its Implementation, And For Other Purposes | Salient points of the bill include: (a) conversion into metric system from picul to LKG which is an internationally-accepted unit of measurement; (b) provision of lien of P10.00; (c) inclusion of health, medical and educational projects under the Socio-Economic projects provision; (d) additional members to the Sugar Tripartite Council. | This bill seeks to amend R.A. No. 6982 to make it more attuned to the present needs and concerns of workers in the sugar industry. | https://www.senate.gov.ph/lisdata/1955816676!.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 10611 | 2013 | 15th | An Act to Strengthen the Food Safety Regulatory System in the Country to Protect Consumer Health and Facilitate Market Access of Local Foods and Food Products, and For Other Purposes, also known as the "Food Safety Act of 2013" | The Sugar Regulatory Administration (SRA) is one of the Food safety regulatory agencies (FSRAs). It is responsible for sugar cane production and marketing. | The law aims to maintain a farm to fork food safety regulatory system that ensures a high level of food safety, promotes fair trade and advances the global competitiveness of Philippine foods and food products. | https://www.officialgazette.gov.ph/2013/08/23/republic-act-no-10611/ | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 2889 | 2013 | 16th | An Act To Remove or Exclude Refined Sugar From The List Of Products Covered By The Mandatory Food Fortification With Vitamin A, Amending For The Purpose Republic Act No. 8976, Otherwise Known As The 'Philippine Food Fortification Act Of 2000' | In view of the various contraints and problems related to the fortification of the said product with Vitamin A, to wit: 1. Sugar refiners - as manufacturers of refined sugar - are not the owners of a large portion of raw sugar, which is processed into refined sugar, and of the resulting sugar that it renders mandatory fortification legally non-implementable. 2. Fortification of refined sugar entails additional cost whihc would result in a higher market price of the product which puts the product beyond the reach of the target consumers (i.e. women and children in lower income brackets) 3. Fortificaiton with Vit A hastens the deterioration of refined sugar which affects the supply stocking programs of refined sugar users. 4. Fortification will lead to a reduction in supply of refined sugar in the market 5. Very weak demand for refined sugar with Vitamin A | This bill seeks to amend the Philippine Food Fortification Act of 2000, removing refined sugar from the mandatory food fortification program. | http://www.congress.gov.ph/legisdocs/basic_16/HB02889.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | Senate Bill No. 738 | 2013 | 16th | An Act Strengthening The Sugar Regulatory Administration And For Other Purposes, "Anti-Sugar Smuggling Act of 2013" | The SRA is tasked to ensure that the supply of domestic sugar and its market is free from illegally imported or smuggled sugar. The SRA is hereby empowered to prevent and suppress the smuggling of sugar and its derivatives through the execution of searches, seizures, and arrests. All confiscted smuggled sugar shall be immediately dumped into the sea within forty (40) days of seizure; Provided that the dumping site is cleared with the Department of Environment and Natural Resources and the Bureau of Fisheries and Aquatic Resources to ensure that the dumping does not bring any significant imbalance to the concerned ecosystem. | The bill seeks to strengthen the government's drive to put a stop to sugar smuggling. | https://www.senate.gov.ph/lisdata/1666613905!.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | Senate Bill No. 1253 | 2013 | 16th | An Act Providing for the Disposition of Smuggled Sugar | No other method of disposition of confiscated smuggled sugar in the custody of the Bureau of Customs shall be allowed except dumping them into the sea in the presence of witnesses consisting of representatives from the Sugar Regulatory Administration, Sugar Industry, and other concerned parties. | The bill seeks to eliminate the loopholes of existing policies regarding the reintroduction of confiscated smuggled sugr into the market. | https://www.senate.gov.ph/lisdata/1732114559!.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | Senate Bill No. 824 | 2013 | 16th | An Act To Stabilize The Sugar Industry By Establishing The Sugar Industry Research And Stabilization Fund And For Other Purposes, also known as the "Sugar Industry Stabilization Act of 2013" | Twenty percent (20%) of the total Value Added Tax (VAT) proceeds collected on sugar and sugar by-products shall, accrue to and form part of a special fund for the sugar industry which shall be made available solely to finance the operation, programs and activities of the Sugar Regulatory Administration in pursuance of its charter objectives. For this purpose, the proceeds as herein provided shall be set aside to constitute a fund known as the Sugar Industry Research and Stabilization Fund which shall be paid out for the purpose herein stated. | This bill seeks to provide the Sugar Regulatory Administration (SRA) with adequate funding to enable it to pursue and carry out its mandates and objectives under its Charter, Executive Order No. 18, dated May 28, 1986. | https://www.senate.gov.ph/lisdata/1680214036!.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 3259 | 2010 | 15th | An Act Enhancing The Powers Of The Sugar Regulatory Administration To Ban The Smuggling Of Sugar And Its Derivatives, Amending Executive Order No. 18, Providing Funds Therefor And Establishing A Policy For Its Implementation And For Other Purposes | The SRA is tasked to ensure that the supply of domestic sugar and its market is free from illegally imported or smuggled sugar. The SRA is hereby empowered to prevent and suppress the smuggling of sugar and its derivatives through the execution of searches, seizures, and arrests. All confiscted smuggled sugar shall be immediately dumped into the sea within forty (40) days of seizure; Provided that the dumping site is cleared with the Department of Environment and Natural Resources and the Bureau of Fisheries and Aquatic Resources to ensure that the dumping does not bring any significant imbalance to the concerned ecosystem. | The bill seeks to strengthen the government's drive to put a stop to unabated sugar smuggling. | http://www.congress.gov.ph/legisdocs/basic_15/HB03259.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Department Order | Department Order No. 100-10 | 2010 | Null | Implementing Rules And Regulations Of The Social Amelioration And Welfare Program In The Biofuel Industry Utilizing Sugarcane As Feedstock | A lien shall be imposed and collected for the implementation of the SAWP for workers engaged in the production of bioethanol fuel and its feedstock, specifically sugarcane. It shall be primarily utilized to augment the income and improve the socio-economic well being of the bioethanol workers. The SAWP lien shall be equal or equivalent to the lien being imposed on raw sugar produced as provided under Republic Act 6982 or the Sugar Amelioration Act of 1991. To ensure non-diminution of existing workers' benefits, conversion of the amount of SAWP lien collected per 50 kilogram (Lkg) of raw sugar produced shall be computed on a per ton cane (TC) for sugarcane feedstock. | DOLE aims to establish a mechanism similar to that provided under Republic Act 6982, otherwise known as the Sugar Amelioration Act of 1991 for the benefit of the biofuel workers. | http://www.sra.gov.ph/wp-content/uploads/2016/05/DO-100-10.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 9513 | 2008 | 14th | An Act Promoting The Development, Utilization And Commercialization Of Renewable Energy Resources And For Other Purposes | Sec 22. Incentives for Farmers Engaged in Plantation of Biomass Resources For a period of ten (10) years after the effectivity of RA 9153, all individuals and entities engaged in the plantation of crops and trees used as biomass resources such as but not limited to jatropha, coconut, and sugarcane, as certified by the Department of Energy, shall be entitled to duty-free importation and be exempted from Value-Added Tax (VAT) on all types of agricultural inputs, equipment and machinery. | The law aims to accelerate the exploration and development of renewable energy resources such as, but not limited to, biomass, solar, wind, hydro, geothermal and ocean energy sources, including hybrid systems, to achieve energy self-reliance, through the adoption of sustainbale energy development strategies to reduce the country's exposure to price fluctuations in the international markets, the effects of which spiral down to almost all sectors of the economy. | http://www.congress.gov.ph/legisdocs/ra_14/RA09513.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Bill | Senate Bill No. 818 | 2007 | 14th | An Act To Reorganize The National Food Authority, Separating Its Regulatory From Its Propriety Functions, Creating The National Grain Council, And The National Grain And Sugar Corporation And Defining Their Powers And Functions, And For Other Purposes | One of the objectives of the bill is to streamline the government‘s involvement in the grain and sugar sector in order to ensure available, adequate and accessible supply of rice, corn grits and sugar during lean periods especially in times of calamities or emergencies at a reduced budgetary cost to government. To carry out the declared policy, there shall be created a body corporate known as the National Grain and Sugar Corporation, herein referred to as the Corporation. | This bill proposes the needed reforms to support the government's food security agenda. The regulatory functions of the NFA will be discharged by the National Grain Council, while its proprietary role will be discharged by a new corporation with government equity. This will allow transparency in policy-making and in import transactions and the maintenance of the required buffer stock for rice and corn. | https://www.senate.gov.ph/lisdata/50464435!.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 9367 | 2006 | 13th | An Act to Direct the Use of Biofuels, Establishing For This Purpose the Biofuel Program, Appropriating Funds Therefor, and For Other Purposes, also known as the "Biofuels Act of 2006" | Sugarcane is one of the feedstocks or organic sources used in the production of biofuels.Provisions of the law include the following, among others: a. The sale of raw material used in the production of biofuels (e.g. sugarcane) shall be exempt from value added tax. b. All liquid fuels for motors and engines sold in the Philippines shall contain locally-sourced biofuels SEC. 10. Security of Domestic Sugar Supply - Any provision of this Act to the contrary notwithstanding, the SRA, pursuant to its mandate, shall, at all times, ensure that the supply of sugar is sufficient to meet the domestic demand and that the price of sugar is stable. To this end, the SRA shall recommend and the proper agencies shall undertake the importation of sugar whenever necessary and shall make appropriate adjustments to the minimum access volume parameters for sugar in the Tariff and Customs Code. | This act aims to reduce dependence on imported fuels with due regard to the protection of public health, environment, and natural ecosystems consistent with the country's sustainable economic growth by mandating the use of biofuels. | https://www.senate.gov.ph/republic_acts/ra%209367.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 8976 | 2000 | 11th | An Act Establishing The Philippine Food Fortification Program And For Other Purposes also known as the "Philippine Food Fortification Act of 2000" | Section 6. Mandatory Food Fortification. - (a) the fortification fo staple foods based on standards sets by the DOH through the BFAD is hereby made mandatory for the following: (3) Refined sugar - with Vitamin A The implementation of the mandatory fortification for wheat flour, refined sugar, cooking oil and rice, including those milled and/or distributed by the National Food Authority, shall commence after four (4) years from the effectivity of this Act. The local government units, through their health officers or agricultural officers or nutritionist-dieticians or the sanitary inspectors shall assist in monitoring/checking that foods to be mandated to be fortified like rice, refined sugar, wheat flour and cooking oil are properly fortified and labeled with "nutrition facts" indicating the specific micronutrient it was fortified with. | The law aims to promote the right of health of the people and instill health consciousness among them by implementing a food fortification program. | http://www.sra.gov.ph/wp-content/uploads/2016/05/RA8976_Food_fortification.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Executive Order | Executive Order No. 18 | 1996 | Null | Creating A Sugar Regulatory Administration | In order to carry out the foregoing policy, a Sugar Regulatory Administration under the Office of the President is hereby created with the following objectives: (A) To institute an orderly system in sugarcane production for the stable, sufficient and balanced production of sugar, for local consumption, exportation and strategic reserves; (B) To establish and maintain such balanced relation between production and requirement of sugar and such marketing conditions as will insure stabilized prices at a level reasonably profitable to the producers and fair to consumers; (C) To promote the effective merchandising of sugar and its by-products in the domestic and foreign markets so that those engaged in the sugar industry will be placed on a basis of economic viability; (D) To undertake such relevant studies as may be needed in the formulation of policies and in the planning and implementation of action programmes required in attaining the purposes of objectives set forth under this Executive Order. | The policy aims to promote the growth and development of the sugar industry through greater and significant participation of the private sector, and to improve the working condition of laborers. | https://www.officialgazette.gov.ph/downloads/1986/05may/19860528-EO-0018-CCA.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 6892 | 1991 | 8th | An Act Strengthening the Social Amelioration Program in the Sugar Industry, Providing the Mechanics for its Implementation, and For Other Purposes | To effectively implement the social and economic programs for workers in the sugar industry pursuant to the provisions of this Act, the Sugar Tripartite Council was created as the advisory body to the Department of Labor and Employment (DOLE) as regards such programs. a) Effective on sugar crop year 1991-1992 a lien of Five pesos (P5.00) per picul of sugar shall be imposed on the gross production of sugar. Eighty percent (80%) of the lien, including any and all incomes or interests derived therefrom, shall be distributed as cash bonus to each worker in the sugar farm or mill based on the proportion of work rendered by him. On recommendation of the Sugar Tripartite Council, the Secretary of Labor and Employment shall use twenty percent (20%) share herein allocated for socio-economic programs, and any and all incomes or interests thereon, for the following: death benefit program, socioeconomic projects for sugar workers, maternity benefits for women sugar workers, administrative expenses of the council. | The law seeks to further strengthen the rights of workers in the sugar industry to their just share in the fruits of production by augmenting their income and, among other schemes, institutionalizing the mechanism among the partners in the sugar industry to enable the workers and their families to enjoy a decent living. | http://www.sra.gov.ph/wp-content/uploads/2016/05/RA-6982_Amelioration_Act.pdf | Sugarcane | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Sugarcane_2024-11-22_processed.xlsx |

ISP for Cacao

PCAARRD ISP on Cacao envisions to increase cacao bean yield, thereby increasing income of smallholder cacao farmers in the countryside.

Strategic R&D

Strategic R&D is DOST-PCAARRD’s banner program comprising all R&D activities that are intended to generate outputs geared towards maximum economic and social benefits

Nutrient management is always of fundamental economic importance in the agriculture of sugarcane. National (and international) efforts face difficulty to gain the maximum production of...

Genomics for Varietal Development With the use of markers for disease resistance, susceptible varieties can immediately be eliminated possibly in one screening only. Thus, cost...

The Central Luzon State University (CLSU) through the leadership of Dr. Armando N. Espino Jr. initiated the project, “Improving Production Efficiency and Cane Yield in...

As the sugarcane industry uses scarce and expensive resources such as water and fertilizers, a solution is required to accelerate the improvement of sugarcane production...

Technologies

Products, equipment, and protocols or process innovations developed to improve productivity, efficiency, quality, and profitability in the agriculture and aquatic industries, and to achieve sustainable utilization and management of natural resources

ULPB-BIOMECH has developed the M3DAS Data Collection Mobile App used in conducting surveys to determine the mechanization resources that can be visually represented through various...

The Department of Science and Technology - Metals Industry Research and Development Center (DOST-MIRDC) in partnership with SRA developed three locally-fabricated sugarcane harvesting equipment for...

The study has clearly shown that there is an avenue to improve the current nutrient management by considering the crop nutrient utilization dynamics to identify...

Fertigroe® nanofertilizers are slow-release formulations of nitrogen (N), phosphorus (P), and potassium (K). These nutrients are encapsulated inside a “carrier,” which protects the nutrients from...

Nutrio® is a foliar spray biofertilizer, which contains endophytic bacteria, a nitrogen-fixing organism isolated, screened, and tested for improved growth and yield of sugarcane. The...

Automating traditional furrow irrigation systems eases the farmers’ burden from labor-intensive irrigation activities. It ensures that irrigation water is applied at a precise amount and...

Policy Research & Advocacy

Analysis of policy concerns and advocacy of science-informed policies ensures that the AANR policy environment is conducive for S&T development and investments.

- Published On: January 15, 2025

Sugarcane production in the Philippines was competitive under export trade and import substitution scenarios. Exporting sugarcane is an excellent opportunity for the country to earn...

- Published On: January 15, 2025

The sugar sector contributes about P90 billion to the Philippine economy annually. Sugarcane is planted in 17 provinces in the Philippines with an estimate of...