Ampalaya Industry Profile

The coconut industry is an important sector of agriculture in the Philippines. With 69 out of 82 provinces in the country producing coconut, the industry has a total production area of 3.62 million hectares and provides an estimate of 2.5 million farmers with employment. Moreover, the Philippines has over 347 million fruit-bearing trees and a total production (mt) of 14.7 million (nut terms) in 2018. As of 2015, domestic consumption of coconut in copra terms was 0.835 million metric tons (Philippine Coconut Authority, 2018). The Philippines also remains to be the second-largest producer of coconut among the Association of Southeast Asian Nations (ASEAN), wherein it comprises almost 40% of ASEAN’s total coconut production (FAOStat, 2018). Major producers of coconut in the Philippines include the regions of CALABARZON, Zamboanga Peninsula, Davao, and Northern Mindanao. Being referred to as the “tree of life” due to its wide array of uses, coconut is mainly exported as products like virgin coconut oil (VCO) and desiccated coconut.

Problems in the Industry

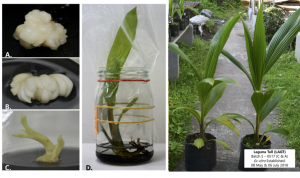

In the past, the coconut industry has experienced various challenges ranging from low production to natural calamities and pest infestations. Certain studies pointed to low productivity being caused by old and senile coconut trees. On the other hand, historical disasters, specifically typhoons Pablo and Yolanda in 2012 and 2013, also instigated massive damages on coconut farms and other key players within the coconut supply chain. The industry further faced numerous infestations from coconut scale insects (CSI), locally known as cocolisap, which were first observed in 2010. The cocolisaps feed on the leaves, fruits and flowers of the coconut tree leaving only the trunk. This disables the production of coconuts, and the remaining use of the tree would simply be as coco-lumber. Although replanting of coconut trees is the immediate solution for the abovementioned problems, it will still take several years for them to reach the optimum maturity for production.

- Price

- Production

- Policies and Programs

- Farm Gate Price

- Retail Price

- Wholesale Price

- Volume

- Value

- Area

- Yield

Coconut Policies

| Policy Type | Policy Number | Policy Year | Congress | Policy Title | Policy Description | Policy Objective | Policy Link | Policy_link |

|---|---|---|---|---|---|---|---|---|

| Law | Commonwealth Act No. 518 | 1.940 | NULL | An Act to Establish the National Coconut Corporation | This Act aims to create the National Coconut Corporation. | Section 1. A corporation is created under the style and name of “National Coconut Corporation,” which shall be organized within six months after the date of the approval of this Act and shall exist for a term of thirty years from the said date. The Corporation shall have its main office in the City of Manila. Section 6. To carry out the purposes of this Act, there is created a special fund to be known as the “Coconut Industry Promotion Fund”, which shall consist of appropriations out of the Coconut Oil Excise Tax Fund collected on and after January first, nineteen hundred and thirty-nine, to be made available as follows: Two million pesos, which is hereby appropriated, upon approval of this Act, and, thereafter, such amounts as may be provided for, from time to time, in the annual appropriation acts for the Coconut Oil Excise Tax Fund. | NULL | |

| Law | Commonwealth Act No. 521 | 1.940 | NA | An Act Appropriating Amounts from the Coconut Oil Excise Tax Fund Collected on and After January First, Nineteen Hundred and Thirty-Nine, for the Period from January First, Nineteen Hundred and Thirty-Nine, to June Thirtieth, Nineteen Hundred and Forty | This act aims to allocate budget accrued from the collection of Coconut Oil Excise Tax collected on and after January 1, 1939 for the period January 1, 1939 to June 30, 1940. | Section 1. Appropriation of funds – The following sums, or so much thereof as may be necessary, are appropriated out of the collections that accrued and shall accrue to the Coconut Oil Excise Tax Fund in the Philippine Treasury… 1. Department of Agriculture and Commerce – P2.8M 2. Department of Public Works and Communications – P10M 3. Government Corporations – P46.4M Section 7. Purpose for which appropriations may be used.— The amounts appropriated in this Act shall be used for the purpose of meeting new or additional expenditures necessary in adjusting Philippine economy to a position independent of trade preferences in the United States and in preparing the Philippines for the assumption of the responsibilities of an independent state, and shall be accounted for separately from other moneys of the Government of the Commonwealth of the Philippines: Provided, That no part of the appropriation herein authorized shall be paid directly or indirectly as a subsidy to the producers or processors of copra, coconut oil, or allied products, except that this provision shall not be construed as prohibiting the use of a portion of said appropriation for facilities for better curing of copra, or for bona fide production loans to Philippine copra producers. | NULL | |

| Law | Commonwealth Act No. 552 | 1.940 | NA | An Act Appropriating Amounts from the Coconut Oil Excise Tax Fund Collected on and After January First, Nineteen Hundred and Thirty-Nine, for the Fiscal Year Ending June Thirtieth, Nineteen Hundred and Forty-One | This act aims to allocate budget accrued from the collection of Coconut Oil Excise Tax collected collected on and after January 1, 1939 for the fiscal year ending June 30, 1941. | Section 1. Appropriation of funds – The following sums, or so much thereof as may be necessary, are appropriated out of the collections that accrued and shall accrue to the Coconut Oil Excise Tax Fund in the Philippine Treasury… 1. Office of the President – P250,000 2. Department of Agriculture and Commerce – P2M 3. Department of Public Works and Communications – P7.5M 4. Government Corporations – P24.5M | NULL | |

| Law | Commonwealth Act No. 627 | 1.941 | NA | An Act Appropriating Amounts from the Coconut Oil Excise Tax Fund Collected on and After January First, Nine Hundred and Thirty-Nine, for the Fiscal Year Ending June Thirtieth, NineTeen Hundred and Forty-Two | This act aims to allocate budget accrued from the collection of Coconut Oil Excise Tax collected collected on and after January 1, 1939 for the fiscal year ending June 30, 1942. | Section 1. Appropriation of funds – The following sums, or so much thereof as may be necessary, are appropriated out of the collections that accrued and shall accrue to the Coconut Oil Excise Tax Fund in the Philippine Treasury… 1. Office of the President – P250,000 2. Department of Agriculture and Commerce – P2.9M 3. Department of National Defense – P3.0M 2. Department of Public Works and Communications – P5.7M 3. Government Corporations – P20.7M | NULL | |

| Law | Commonwealth Act No. 718 | 1.945 | NA | An Act Appropriating the Sum of Two Million Nine Hundred Forty-One Thousand Pesos from the Coconut Oil Excise Tax Fund Collected on and After January First, Nineteen Hundred and Thirty-Nine, for Certain Activities Under the Department of Agriculture and Commerce, for the Fiscal Year Ending June Thirtieth, Nineteen Hundred and Forty-Six | This act aims to allocate budget accrued from the collection of Coconut Oil Excise Tax collected collected on and after January 1, 1939 for the fiscal year ending June 30, 1946. | Section 1. Appropriation of funds – The following sums, or so much thereof as may be necessary, are appropriated out of the collections that accrued and shall accrue to the Coconut Oil Excise Tax Fund in the Philippine Treasury… (a) Appropriation to continue the agronomical survey of the Philippines in accordance with the provisions of Commonwealth Act No. 418 (b) Appropriation for the establishment, improvement, development, maintenance, and operation of agricultural experiment and demonstration stations under the provisions of section 1754 of the Administrative Code c) Appropriation to continue the reforestation and afforestation of watersheds, denuded areas, and cogon or open lands within forest reserves, communal forests, National parks, and timberlands, sand dunes, and such other areas already certified as public forest lands, in accordance with the provisions of Commonwealth Act No. 304 (d) Appropriation to continue the classification, survey and subdivision of agricultural lands of the public domain especially those lying along the National highways, the sum of ₱170,000 to be spent by the Bureau of Forestry in accordance with Commonwealth Act. No. 627 and the sum of ₱1,180,000 to be spent by the Bureau of Lands in accordance with the said Commonwealth Act No. 630 e) For the organization, maintenance and operation of a School of Fisheries under the Division of Fisheries (f) For the creation of a special fund to be known as the “Cinchona Plantation Revolving Fund” for the establishment, cultivation, development, maintenance, and operation of cinchona plantations in public forest lands to be administered by the Bureau of Forestry | NULL | |

| Law | Republic Act No. 5 | 1.946 | 1st | An Act to Amend Sections Two and Five of Commonwealth Act Numbered Five Hundred Eighteen, Entitled “An Act to Establish the National Coconut Corporation, and to Appropriate Additional Operating Capital for Said Corporation” | This Act aims to amend the functions of the National Coconut Corporation. | Section two of Commonwealth Act Numbered Five hundred eighteen is amended to read as follows: “Sec. 2. The National Coconut Corporation shall have the following objects: (c) To buy, sell, barter, export, and in any other manner deal in, coconut, copra, and desiccated coconut, as well as their by-products, and to act as agent, broker or commission merchant of the producers, dealers or merchants of coconut, copra, and desiccated coconut or their by-products.” Sec 5. “The President may, in his discretion, remove any director. The directors serving upon the passage of this Act shall remain in office until relieved by the President. Four members of the board of directors shall constitute a quorum for the transaction of business. | NULL | |

| Law | Republic Act No. 362 | 1.949 | 2nd | An Act Appropriating the Sum of Three Hundred Thousand Pesos for the Study, Control and Eradication of the “Kadang-Kadang” and Other Diseases or Pests of Coconut Trees | This Act aims to appropriate funds for the study, control, and eradication of the “Kadang-Kadang” and other diseases or pests of coconut trees. | The sum of three hundred thousand pesos, or so much thereof as may be necessary and certified as to its availability by the Auditor General, is hereby appropriated out of any funds in the National Treasury not otherwise appropriated, for the study, control, and eradication of the “Kadang-Kadang” and other diseases or pests of coconut trees. | NULL | |

| Law | Republic Act No. 471 | 1.950 | 2nd | An Act Providing that Fifty Per Centum of the Fees Collected from the Copra Standardization and Inspection Service by Virtue of Commerce Administrative Order Numbered Two,dated January Sixteen, Nineteen Hundred Forty-Eight, Shall be Paid to the Funds of the National Coconut Corporation for the Rehabilitation of the Coconut Industry | This Act aims to create a special fund from the Copra Standardization and Inspection Service for the rehabilitation of the coconut industry. | To enable the National Coconut Corporation to advance further its program of industrialization of the coconut industry and the proper utilization of coconut by-products as well as the improvement of the quality of Philippine copra, fifty per centum of all the fees collected by the Bureau of Commerce from the Copra Standardization and Inspection Service pursuant to Commerce Administrative Order Numbered Two, dated January sixteen, nineteen hundred forty-eight, of the Department of Commerce and Industry, shall be kept as a special fund and turned over to the National Coconut Corporation beginning June first, nineteen hundred and fifty, to be spent for the purposes mentioned in subsections (a) and (b) of section two of Commonwealth Act Numbered Five hundred eighteen, as amended. | NULL | |

| Law | Republic Act No. 773 | 1.952 | 2nd | An Act Appropriating the Sum of Five Hundred Thousand Pesos for the Study, Control and Eradication of Coconut and Other Plant Diseases and Pests, Including Rats | This Act aims to appropriate funds for the study, control, and eradication of the coconut and other plant diseases, including rats. | The sum of five hundred thousand pesos is hereby appropriated out of any funds in the National Treasury not otherwise appropriated for the study, control and eradication of coconut and all other plant diseases and pests, including rats. | NULL | |

| Law | Republic Act No. 1145 | 1.954 | 3rd | An Act Creating the Philippine Coconut Administration, Prescribing its Powers, Functions and Duties, and Providing for the Raising of the Necessary Funds for its Operation | This Act aims to establish the Philippine Coconut Administration. | A corporation is hereby created which shall be known as the Philippine Coconut Administration, hereafter called the PHILCOA, which shall be organized within sixty days after the approval of this Act and shall be under the direct supervision of the Office of Economic Coordination. The PHILCOA shall have the following purposes and objectives: (a) To ensure the steady and orderly development of the coconut industry, and to stabilize and strengthen its position in the world markets; (b) To promote the effective merchandising of copra, coconut oil, coconut products and by-products in the domestic and foreign markets so that those who are engaged in the coconut industry will be placed on a basis of economic security; (c) To improve the tenancy relations between coconut proprietors and tenants and the living conditions of laborers engaged in the coconut industry; (d) To encourage the invention of useful machinery that will hasten the development of the coconut industry. | NULL | |

| Law | Republic Act No. 1369 | 1.955 | 3rd | An Act Appropriating the Sum of Thirty Million Pesos, Out of the Proceeds of the Sale of Bonds to be Issued Under Republic Act Numbered One Thousand or from Any Loan, for the Purpose of Financing the Manufacture of Coconut Products and By-Products and the Component Parts of Coconut Trees, and Otherwise for the Industrialization of the Coconut Trees and Coconut Products and By-Products | This Act aims to appropriate funds for the industrialization of the coconut industry, particularly provision of budget for the manufacture of coconut products and by-products. | There is hereby appropriated, out of the proceeds of the sale of bonds to be issued under Republic Act Numbered One thousand or from any loan, the sum of thirty million which shall be invested: (a) in the construction, establishment and operation of necessary centrals or mills for the manufacture, on commercial scale, or industrialization of coconut products and by-products and the component parts of coconut trees, hereinafter called coconut centrals; or (b) in loans to persons who are citizens of the Philippines or to associations or corporations organized under the laws of the Philippines, the capital of which is owned by the citizens of the Philippines, for the purpose of financing the establishment of such centrals or mills; or (c) in shares, hereafter called contributions, or in subscriptions by the Government to the capital of such associations or corporations engaged or which will engage in such enterprise or coconut industrialization. | NULL | |

| Law | Republic Act No. 2282 | 1.959 | 4th | An Act to Promote the Development of the Coconut Industry | This Act aims to be a national policy that will promote to the fullest extent possible the rapid development of the coconut industry by subproviding for an adequate financing of coconut cooperatives and coconut producers. | To implement the policy declared in this Act there is hereby created a Coconut Financing Fund which shall be deposited with and administered by the Development Bank of the Philippines and which shall be constituted, either (a) by an mount not exceeding thirty million pesos out of the sale of bonds which shall be issued by the President of the Philippines upon recommendation of the National Economic Council, or (b) by the sum of thirty million pesos which is hereby appropriated out of any funds in the National Treasury not otherwise appropriated, ten million pesos of which shall be made available within one year after the approval of this Act and five million pesos made available every year thereafter until the full amount of thirty million pesos is totally released. | NULL | |

| Law | Republic Act No. 4059 | 1.964 | 5th | An Act Establishing the Philippine Coconut Research Institute, Defining its Objectives, Powers and Functions, Authorizing the Appropriation of Funds Therefor, and for Other Purposes | This Act aims to create the Philippine Coconut Research Institute. | There is hereby created the Philippine Coconut Research Institute, hereinafter referred to as the PHILCORIN, with its main executive office in the City of Manila. The PHILCORIN shall have the following purposes and objectives: (a) To conduct scientific researches and investigations on: (1) the botanical and genetical aspects of coconut improvement; (2) the agronomical problems relating to coconut culture; (3) the etiology and control of “kadang-kadang” and other diseases of coconut; and (4) the biology and control of important insect pests of coconut; (b) To compile scientific information and disseminate results of scientific and technological researches on coconut; and (c) To train people for the development of the coconut industry. | NULL | |

| Law | Republic Act No. 4403 | 1.965 | 5th | An Act Encouraging the Organization of Agro-Industrial Coconut Cooperatives Under the Jurisdiction of the Philippine Coconut Administration, Amending for the Purpose Republic Act Numbered Eleven Hundred Forty-Five | This Act aims to amend RA 1145 and enable the organization of agro-industrial coconut cooperatives under PHILCOA. | Section three of Republic Act Numbered Eleven hundred forty-five is amended to read as follows: “(f) To help planters and processors organize themselves into associations and/or agro-industrial coconut cooperatives with a view to giving them greater control in the marketing of their products, to help them obtain more credit facilities, and to assist them in getting more participation in the income of the coconut industry, such agro-industrial cooperatives shall be registered with the Securities and Exchange Commission and, any law to the contrary notwithstanding, enjoy the following privileges. | NULL | |

| Law | Republic Act No. 5898 | 1.969 | 6th | An Act Establishing a Coconut Breeding Station and Nursery in the Municipality of Pantukan, Province of Davao del Norte, and Authorizing the Appropriation of Funds Therefor | This Act aims to provide funds for the establishment of a Coconut Breeding Station and Nursery in Pantukan, Davao del Norte. | There shall be established under the supervision of the Philippine Coconut Administration a coconut breeding station and nursery in the Municipality of Pantukan, Province of Davao del Norte, to be known as Pantukan Coconut Breeding Station and Nursery. The sum of one hundred thousand pesos is hereby authorized to be appropriated out of any funds in the National Treasury not otherwise appropriated, for the establishment, operation and maintenance of said coconut breeding station and nursery. Thereafter, the necessary funds needed for its operation and maintenance shall be included in the annual General Appropriations Act. | NULL | |

| Law | Republic Act No. 6260 | 1.971 | 7th | An Act Instituting a Coconut Investment Fund And Creating A Coconut Investment Company For The Administration Thereof | This Act aims to be the national policy to accelerate the development of the coconut industry through the provision of adequate medium and long-term financing for capital investment in the industry, by instituting a Coconut Investment Fund capitalized and administered by coconut farmers through a Coconut Investment Company. | Section 2. Declaration of Policy. It is hereby declared to be the national policy to accelerate the development of the coconut industry through the provision of adequate medium and long-term financing for capital investment in the industry, by instituting a Coconut Investment Fund capitalized and administered by coconut farmers through a Coconut Investment Company. Section 8. The Coconut Investment Fund. There shall be levied on the coconut farmer a sum equivalent to fifty-five centavos (P0.55) on the first domestic sale of every one hundred kilograms of copra, or its equivalent in terms of other coconut products, for which he shall be issued a receipt which shall be converted into shares of stock of the Company upon its incorporation as a private entity in accordance with Section seven hereof. For every fifty-five centavos (P0.55) so collected, fifty centavos (P0.50) shall be set aside to constitute a special fund, to be known as the Coconut Investment Fund, which shall be used exclusively to pay the subscription by the Philippine Government for and in behalf of the coconut farmers to the capital stock of said Company Section 9. …Three centavos (P0.03) out of every fifty-five centavos (P0.55) collected shall be set aside to be used exclusively to defray the expenses for: (a) the setting up and continued operation of the machinery for the collection and acknowledgment of payment, (b) the organization of municipal and provincial conventions of coconut planters, (c) the organization, supervision and conduct of regional coconut conventions and a national coconut congress, and (d) production and dissemination of information: Provided, finally, That the remaining two centavos (P0.02) shall be placed at the disposition of the recognized national association of coconut producers with the largest number of membership as determined by the Philippine Coconut Administration for the maintenance and operation of its principal office which shall be responsible for continuing liaison with the different sectors of the industries, the government and its own mass base. | NULL | |

| Law | Presidential Decree No. 232 | 1.973 | NA | Creating a Philippine Coconut Authority | This Act aims to create the Philippine Coconut Authority (PCA) to promote accelerated growth and development of the coconut and other palm oils industry so that the benefits of such growth shall accrue to the greatest number, and to provide continued leadership and support in the integrated development of the industry. | Section 1. Declaration of Policy. It shall be the policy of the state to promote accelerated growth and development of the coconut and other palm oils industry so that the benefits of such growth shall accrue to the greatest number, and to provide continued leadership and support in the integrated development of the industry. Section 6. Abolished Agencies and Transitory Provisions. The Coconut Coordinating Council (CCC), the Philippine Coconut Administration (PHILCOA) and the Philippine Coconut Research Institute (PHILCORIN) are hereby abolished and their powers and functions transferred to the Philippine Coconut Authority, together with all their respective appropriations, funding from all sources, equipment and other assets, and such personnel as are necessary | https://www.officialgazette.gov.ph/1973/06/30/presidential-decree-no-232-s-1973/ | |

| Law | Presidential Decree No. 276 | 1.973 | NA | Establishing a Coconut Consumers Stabilization Fund | This Act aims to establish a Coconut Consumers Stabilization Fund that will be used to address the abnormal price situtation of utilized to subsidize the sale of coconut-based products at prices set by the Price Control Council. | the Philippine Coconut Authority is hereby authorized to formulate and immediately implement a stabilization scheme for coconut-based consumer goods, along the following general guidelines: a. A levy, initially, of ₱15.00 per 100 kilograms of copra resecada or its equivalent in other coconut products, shall be imposed on every first sale, in accordance with the mechanics established under RA 6260, effective at the start of business hours on August 10, 1973. b. b. The Fund shall be utilized to subsidize the sale of coconut-based products at prices set by the Price Control Council, under rules and regulations to be promulgated by the Philippine Consumers Stabilization Committee The collection of the Stabilization Fund Levy and the existence of the Stabilization Committee shall terminate after one year or earlier, provided the crisis for which the measure was instituted no longer exists as determined by the Philippine Coconut Authority | https://www.officialgazette.gov.ph/1973/08/20/presidential-decree-no-276-s-1973/ | |

| Law | Presidential Decree No. 271 | 1.973 | NA | Amending Presidential Decree No. 232 Creating a Philippine Coconut Authority | This Act aims to amend the composition of the governing board of PCA. | Amended: Section 4. Governing Board. The Authority shall be governed by a Board of nine members who shall meet as often as necessary Section 5. Management. The management of the Authority shall be vested in an Administrator | https://www.officialgazette.gov.ph/1973/08/09/presidential-decree-no-271-s-1973/ | |

| Decree | Presidential Decree No. 514 | 1.974 | NA | Amending Republic Act No. 6260, Entitled An “Act Instituting A Coconut Investment Fund And Creating A Coconut Investment Company For The Administration Thereof.” | This Act aims to modify the composition of the Board to further enhance coordination of the Company’s operations with established government policies and programs. | Section 1. The Chairman of the Board and the General Manager of the Coconut Investment Company shall be appointed by the President during the period that the Company is a government corporation. They shall, together with the eleven (11) members specified under Republic Act No. 6260, comprise a Board of Directors of 13 members which shall exercise the corporate powers of the Company. | https://www.officialgazette.gov.ph/1973/06/30/presidential-decree-no-232-s-1973/ | |

| Law | Presidential Decree No. 527 | 1.974 | NA | Granting Authority to the National Economic and Development Authority to Set Minimum Prices of Coconut Oil, Copra and Other Coconut Products and by Products | This Act aims to protect coconut farmers byt regulating or fixing the minimum prices at which copra and other coconut products and by-products may be purchased from coconut farmers, as well as minimum export prices for copra, coconut oil and other coconut products and by-products. | The National Economic and Development Authority, motu proprio or upon recommendation of the Philippine Coconut Authority, may fix the minimum prices that may be paid to coconut farmers for copra and other coconut products, as well as minimum export prices for copra, coconut oil and other coconut products and by-products whenever the national interest so requires taking into consideration cost of production, transportation, marketing and other relevant factors. | https://www.officialgazette.gov.ph/1974/08/02/presidential-decree-no-527-s-1974/ | |

| Law | Presidential Decree No. 755 | 1.975 | NA | Approving the Credit Policy for the Coconut Industry as Recommended by the Philippine Coconut Authority and Providing Funds Therefor | This Act aims to provide readily available credit facilities to the coconut farmers at preferential rates. | It is hereby declared that the policy of the State is to provide readily available credit facilities to the coconut farmers at preferential rates; that this policy can be expeditiously and efficiently realized by the implementation of the “Agreement for the Acquisition of a Commercial Bank for the benefit of the Coconut Farmers” executed by the Philippine Coconut Authority, the terms of which “Agreement” are hereby incorporated by reference; and that the Philippine Coconut Authority is hereby authorized to distribute, for free, the shares of stock of the bank it acquired to the coconut farmers under such rules and regulations it may promulgate. The Philippine Coconut Authority is hereby directed to draw and utilize the collections under the Coconut Consumers’ Stabilization Fund authorized to be levied by Presidential Decree No. 232, as amended, to pay for the financial commitments of the coconut farmers under the said agreement and, except for the budgetary requirements of the Philippine Coconut Authority as approved by its Governing Board, all collections under the Coconut Consumers’ Stabilization Fund Levy and fifty percent (50%) of the collections under the Coconut Industry Development Fund shall be deposited, interest free, with the said bank of the coconut farmers | https://www.officialgazette.gov.ph/1975/07/29/presidential-decree-no-755-s-1975/ | |

| Law | Presidential Decree No. 961 | 1.976 | NA | An Act to Codify the Laws Dealing with the Development of the Coconut and Other Palm Oil Industry and for Other Purposes, also known as the “Coconut Industry Code” | This Act aims to restate the laws regarding the PCA, levies, penalties, and miscellaneous provisions concerning the coconut industry. | Declaration of Policy. It is hereby declared to be the policy of the State to promote the rapid integrated development and growth of the coconut and other palm oil industry in all its aspects and to ensure that the coconut farmers become direct participants in, and beneficiaries of, such development and growth. Article I. The Philippine Coconut authority Article II. Levies Article III. Penalties Article V. Miscellaneous Provisions | https://www.officialgazette.gov.ph/1976/07/14/presidential-decree-no-961-s-1976/ | |

| Law | Presidential Decree No. 1468 | 1.978 | NA | Revising Presidential Decree Numbered Nine Hundred Sixty One | There is a need to restructure the provisions of Presidential Decree No. 961 in order to meet the changes of the times and to provide more effective means of achieving the objectives of the coconut industry as expressed in said Decree | This Decree shall be known as the “Revised Coconut Industry Code”. To implement and attain the declared national policy, there is hereby created an independent public corporation to be known as the Philippine Coconut Authority, hereinafter referred to as Authority, directly reporting to, and supervised by, the President of the Philippines. The Authority is hereby empowered to impose and collect a levy to be known as the Coconut Consumers Stabilization Fund Levy, on every one hundred kilos of copra rececade, or its equivalent in other coconut products delivered to, and/or purchased by, copra exporters, oil millers, desiccators and other end-users of copra or its equivalent in other coconut products. The levy shall be paid by such copra exporters, oil millers, desiccators and other end-users of copra or its equivalent in other coconut products under such rules and regulations as the Authority may prescribe. There is also hereby created a permanent fund to be known as the Coconut Industry Development Fund, which shall be administered and utilized by the bank acquired for the benefit of the coconut farmers under PD 755. As the initial funds of the Coconut Industry Development Fund, the Authority is hereby directed to pay to the Coconut Industry Development Fund the amount of One Hundred Million Pesos (P100,000,000.00) out of the Coconut Consumers Stabilization Fund and thereafter the Authority shall pay to the said Fund an amount equal to at least twenty centavos (P0.20) per kilogram of copra resecada or its equivalent out of its current collections of the Coconut Consumer Stabilization Fund Levy. | https://www.officialgazette.gov.ph/1978/06/11/presidential-decree-no-1468-s-1978/ | |

| Letter of Instruction | Letter of Instruction No. 926 | 1.979 | NA | Rationalization of the Coconut Oil Milling Industry | This Act aims to rationalize the coconut oil milling industry and insure its survival, viability and stability and thereby assure the consuming countries of an adequate and continuous supply, at fair and reasonable prices, of copra, coconut oil and their by-products | It is hereby declared to be the policy of the State to rationalized the coconut oil milling industry and insure its survival, viability and stability and thereby assure the consuming countries of an adequate and continuous supply, at fair and reasonable prices, of copra, coconut oil and their by-products; that this policy can be expeditiously and efficiently realized by the pooling of the resources and the coordination of the copra buying and selling, oil milling and marketing efforts of both the coconut farmers and the oil millers in order that the optimum benefits resulting from economies of scale may be realized; and that the most appropriate vehicle for such pooling and coordination is a joint venture company between the coconut farmers and the oil millers. The Bank acquired for the benefit of the coconut farmers pursuant to the provisions of P.D. 755, in its capacity as the investment arm of the coconut farmers thru the Coconut Industry Investment Fund (CIIF) created by P. D. 1468, is hereby directed to invest, on behalf of the coconut farmers, such portion of the CIIF as may be necessary in a private corporation which shall serve as the instrument to pool and coordinate the resources of the coconut farmers and the oil millers in the buying, milling and marketing of copra and its by-products | https://www.officialgazette.gov.ph/1979/09/03/letter-of-instruction-no-926-s-1979/ | |

| Law | Presidential Decree No. 1699 | 1.980 | NA | An Act Suspending the Collection of the Coconut Consumers Stabilization Fund Levy and Similar Levies and Providing in Connection Therewith Appropriate Measures to Cushion the Adverse Effects Thereof on the Coconut Farmers | This Act aims to suspend the collection of levies, particulalry of the Coconut Consumers Stabilization fund (CCSF) and Coconut Industry Development Fund (CIDF). | Subject to the provisions of this Act, the collection of the Coconut Consumers Stabilization Fund (CCSF) and the Coconut Industry Development Fund (CIDF) levies for the exportable coconuts, copra, coconut oil, desiccated coconut and their respective by-products and derivatives (hereinafter collectively referred to as “coconut products”) are hereby suspended and the burden thereof shall be shifted to the exporters of such coconut products as herein elsewhere provided. To insure the continuance and the viability of the different developmental projects for the benefit of the coconut farmers that are being financed from out of the collections of the CCSF levy as identified and prescribed by Presidential Decree No. 1468, Article III, Section 2, the exporters of coconut products shall pay, as part of their cost of operations, such amount as may be necessary or required to assure the adequate and the continuous financing of such developmental projects including the cost and expenses incurred in effecting the rationalization of the oil milling industry as prescribed by Letter of Instructions No. 926, the provisions of which are herein incorporated as parts of this Act. Hereafter, no exportation of coconut products shall be allowed unless the Philippine Coconut Authority shall have certified that the assessable collection on the proposed export has been paid by the exporter. | https://www.officialgazette.gov.ph/1980/05/27/presidential-decree-no-1699-s-1980/ | |

| Law | Presidential Decree No. 1644 | 1.980 | NA | Granting Additional Powers to the Philippine Coconut Authority | This Act aims to further promote the rationalization of the coconut oil milling industry by granting the Philippine Coconut Authority additional powers in respect of the marketing and export of copra, coconut oil and their by-products | In the exercise of its powers under Section 1 hereof, the Philippine Coconut Authority may initiate and implement such measures as may be necessary to attain the rationalization of the coconut oil milling industry, including, but not limited to, the following measures: a) Imposition of floor and/or ceiling prices for all exports of copra, coconut oil and their by-products; b) Prescription of quality standards; c) Establishment of maximum quantities for particular periods and particular markets; d) Inspection and survey of export shipments through an independent international superintendent or surveyor. | https://www.officialgazette.gov.ph/1979/10/04/presidential-decree-no-1644-s-1979/ | |

| Law | Presidential Decree No. 1768 | 1.981 | NA | Establishing Agro-Forest Reserves Within the Agusan Valley for the Implementation of the Nationwide Coconut Replanting Program | This Act aims to formulate and implement a nationwide replanting program using precocious high-yielding hybrid seednuts, which program may include the planting of new areas. | PCA is hereby authorized to enter into agreements for the development of the areas referred to in Section 1 above, by way of agro-forest lease, with the coconut farmers of the Philippines, acting thru the Coconut Industry Investment Fund and/or the Coconut Industry Development Fund, and/or with the persons or entities who have availed of the provisions of Republic Act No. 926. The agro-forest reserves established by this Decree shall be incorporated in the nationwide coconut replanting program as formulated and implemented by the PCA. | https://www.officialgazette.gov.ph/1981/01/12/presidential-decree-no-1768-s-1981/ | |

| Law | Presidential Decree No. 1842 | 1.983 | NA | Amending Certain Provisions of Presidential Decree No. 1841 and Creating a Coconut Reserve Fund | This Act aims to amend PD 1841 and create a Coconut Reserve Fund to effect a more realistic system of determining the amount of assessment of coconuts and its products in order to provide urgent relief to coconut farmers while at the same time ensuring continued financial support to on-going socio-economic and developmental programs for coconut farmers. | Sections 1 and 2, Article III of Presidential Decree No. 1468, as amended by Presidential Decree No. 1841 are hereby further amended to read as follows: Sec. 1. Coconut Industry Stabilization Fund. To ensure the viability and stability of the coconut industry as a whole, the copra exporters, the oil millers, the refiners, the desiccators and other end-users of copra or its equivalent in other coconut products are hereby assessed an amount equivalent to a specific percentage of the prevailing copra equivalent of the world market price of coconut oil which shall be imposed on copra resecada or its equivalent in other coconut products delivered to and/or purchased by them. Sec. 2-A. Coconut Reserve Fund. To ensure continued financial support to critical socio-economic and developmental programs mentioned in Section 1 hereof in times of depressed world prices for coconut, a Coconut Reserve Fund is hereby constituted from assessments in excess of ₱50 per on hundred (100) kilos of copra resecada or its equivalent in other coconut products, provided, however, that no disbursements therefrom may be made unless the applicable assessment in specific percentage falls to eleven percent (11%) or below as defined and computed in Section 1 hereof. | https://www.officialgazette.gov.ph/1982/01/16/presidential-decree-no-1842-s-1982/ | |

| Law | Presidential Decree No. 1841 | 1.983 | NA | Prescribing a System of Financing the Socio-Economic and Developmental Program for the Benefit of the Coconut Farmers and Accordingly Amending the Laws Thereon | This Act aims to prescribe a new system of financing the socio0economic and development program for coconut farmers | Sections 1 and 2, Article III, of Presidential Decree No. 1468, are hereby substituted with the following: Sec. 1. Coconut Industry Stabilization Fund. To ensure the viability and the stability of the coconut industry as a whole, the copra exporters, the oil millers, the refiners, the dessicators and other end-users of copra or its equivalent in other coconut products are hereby assessed an amount equivalent to ₱50.00 for every 100 kilos of copra resecada or its equivalent in other coconut products delivered to, and/or purchased by them which assessments are hereby constituted as the Coconut Industry Stabilization Fund. The assessments shall be collected and disbursed by the Authority as herein prescribed.” “Sec. 2. The collections of the Coconut Industry Stabilization Fund shall be utilized for, and the assessment of P50.00 per one hundred kilos of copra resecada or its equivalent in coconut products shall be proportionately allocated among the following socio-economic and developmental programs for the benefit of the coconut farmers, in particular, and the coconut industry Section 5. Hereafter, the words “levy”, “levies” and “Coconut Consumers Stabilization Fund” in PD 1468 shall, if the context so requires, be substituted with the words “assessment”, “assessments” and “Coconut Industry Stabilization Fund,” respectively. Section 11. Financing of other Socio-Economic and Developmental Projects. — The members of the coconut industry, particularly the commercial and industrial sectors thereof may, if they so desire, establish a system of financing the socio-economic and/or developmental projects for the coconut industry in addition to Section 1 hereof under such terms and conditions as they may freely negotiate and agree upon which are hereby declared to constitute an onerous contract enforceable according to its terms. | https://www.officialgazette.gov.ph/1981/10/02/presidential-decree-no-1841-s-1981/ | |

| Law | Presidential Decree No. 1863 | 1.984 | NA | An Act to Promote and Expand the Utilization of Chemicals Derived from Coconut Oil and for Other Purposes | This Act aims to encourage, promote and assist the substitution of coco-chemicals for petro-chemicals in the manufacture of soaps, detergents and other consumer and industrial products | Section 1. Declaration of Policy. It is hereby declared to be the policy of the State to establish, promote, and assist the development of a coco-chemical industry in the country and by way of implementing this policy, the Government has adopted, as one of the major industrial projects of the country, the establishment and operation of manufacturing facilities for the production of coco-chemicals by the United Coconut Chemicals, Inc. (“UNICHEM”) which is owned and controlled by the coconut farmers of the Philippines. Within the period herein prescribed, enterprises established either by existing or new companies which will utilize coco-chemicals as raw materials feedstock in the manufacture, processing or production of goods, products, or commodities are hereby declared pioneer enterprises in a preferred area of investment The importation and the use in the Philippine detergents grade alcohols and their derivatives as may hereafter be determined pursuant to Section 7 herein, are hereby prohibited and shall be allowed only in the manner and n the instances prescribed under Section 6 hereof. | https://www.officialgazette.gov.ph/1983/04/18/presidential-decree-no-1863-s-1983/#:~:text=%E2%80%94%20It%20is%20hereby%20declared%20to,establishment%20and%20operation%20of%20manufacturing | |

| Law | Presidential Decree No. 1854 | 1.984 | NA | Authorizing an Adjustment of the Funding Support of the Philippine Coconut Authority and Instituting a Procedure for the Management of Such Fund | This Act aims to adjust the authorized industry support to PCA by providing the agency with adequate financial means and resources to more effectively carry out its task. | The PCA fee imposed and collected pursuant to the provisions of R.A. No. 1145 and Sec. 3(k), Article II of P.D. 1468, is hereby increased to three centavos per kilo of copra or husked nuts or their equivalent in other coconut products delivered to and/or purchased by copra exporters, oil millers, desiccators and other end-users of coconut products. The fee shall be collected under such rules that PCA may promulgate, and shall be paid by said copra exporters, oil millers, desiccators, and other end-users of coconut products, receipt of which shall be remitted to the National Treasury on a quarterly basis. | https://www.officialgazette.gov.ph/1982/12/21/presidential-decree-no-1854-s-1982/ | |

| Executive Order | Executive Order No. 1016 | 1.985 | NA | Withdrawing the Inspection, Commodity and Export Clearance Requirements on Philippine Exports | This Act aims to eliminate the inspection, commodity clearance, and export clearance requirements of the government to facilitate exports. Coconut, however, is among the controlled products for exportation. | Section 4. Controlled, prohibited and banned products – For the purposes of these rules and regulations, the following shall be classified as controlled products for exportation from the Philippines, and shall continue to be subject to Certificate of Exemption prior to exportation, issued by the appropriate government office, bureau, agency or instrumentality opposite them: 12. Matured coconuts and coconut seedlings – PCA | http://pca.gov.ph/images/pdf/issuances/EO1016s1985.pdf | |

| Law | Presidential Decree No. 1972 | 1.985 | NA | An Act to Finance the Coconut Replanting Program | This Act aims to finance the replanting program and that for this purpose, the export duty and the additional export duty on coconut products be utilized as the initial source of financing. | Section 1. The basic export duty imposed by Section 514 of Presidential Decree No. 1464, and the additional export duty imposed by Executive Order No. 920-A, on coconut products, as identified and at the rates prescribed by Executive Order No. 920-A, which is hereby incorporated made part hereof any reference, are hereby made permanently constituted as the initial source of financing for the Philippine Coconut Authority (“PCA”), with the active assistance and participation of the recognized organization of the coconut farmers pursuant to the provisions of Act No. 6260. Section 2. In the implementation of the replanting program, the PCA shall service the requirements of small coconut farmers owning not more than twenty-four (24) hectares who volunteer to participate in the replanting program. Initially, the PCA shall give priority to the devastated areas in the Visayas and Mindanao. Section 3. In accordance with the self-reliance program of the country, and to encourage the private sector to device and implement their own area planting and/or replanting program, copra millers/refiners and other exporters of coconut products which voluntarily form associations and/or cooperatives in accordance with the provisions of Presidential Decree No. 1960, are hereby exempted from payment of the basic export duty and the additional export duty on coconut products herein imposed…. | https://www.officialgazette.gov.ph/1985/04/08/presidential-decree-no-1972-s-1985/ | |

| Law | Presidential Decree No. 1960 | 1.986 | 10th | Prescribing Measures for the Structural Economic Adjustment Program for the Coconut Industry | This Act aims to lessen Government intervention in the marketing of coconut products and allow the private sector greater access to the markets, and at the same time encourage and require the private sector to establish and adopt appropriate measures to enhance the competitiveness of coconut products in the world market. | PCA Administrative Orders are repealed and all oil millers are permitted and authorized to export their coconut products to the world market subject only to such rules and regulations that the Ministry of Trade and Industry, the Central Bank and PCA may prescribe to ensure that coconut products are sold at competitive prices in relation to other fats and oils and that the proceeds of such sales, less actual expenses, are remitted to the country. To ensure the survival of the coconut oil milling/refining industry while there is an excess of copra crushing/refining capacity and to encourage fresh equity to be invested in existing coconut oil milling/refining capacities, no new copra crushing/refining capacity shall be allowed without the respective approvals of the Ministry of Trade and Industry, the Ministry of Agriculture and Food and the PCA. To assure the coconut farmers a return on their investment and to honor the commitments of the cooperative endeavor and the country as well, in the domestic and international markets, including the financial markets, all rights and obligations acquired or incurred by the cooperative endeavor in implementation of the rationalization program for the coconut industry mandated by LOI 926 and duly approved by appropriate governmental agencies must necessarily be assigned, transferred or sold, pro rata and under reasonable terms and conditions, to the coconut oil millers/refiners who desire to service the world market, including oil mills/refineries owned or controlled by the coconut farmers of the Philippines as provided in Presidential Decrees No. 961 and 1468, as amended. | https://www.officialgazette.gov.ph/1985/01/11/presidential-decree-no-1960-s-1985/ | |

| Law | Republib Act No. 8048 | 1.995 | 9th | An Act Providing for the Regulation of the Coconut Trees, Its Replenishment, Providing Penalties Therefor and For Other Purposes, also known as the “Coconut Preservation Act of 1995. | This Act aims toregulate the unabated and indiscriminate cutting of the coconut trees. For reasons of national interest, it is hereby declared the policy of the State to provide for the growth of the industry by embarking on a sustainable and efficient replanting program. | SEC. 4. Prohibition. – No coconut tree shall be cut except in the following cases and only after a permit had been issued therefor: a) When the tree is sixty (60) years old; b) When the tree is no longer economically productive; c) When the tree is disease-infested; d) When the tree is damaged by typhoon or lightning; e) When the agricultural land devoted to coconut production shall have been converted in accordance with law into residential, commercial or industrial areas; f) When the land devoted to coconut production shall be converted into other agricultural uses or other agriculture-related activities in pursuance to a conversion duly applied for by the owner and approved by the proper authorities; and g) When the tree would cause hazard to life and property. SEC. 5. Permit to Cut. – No coconut tree or trees shall be cut unless a permit therefore, upon due application being made, has been issued by the PCA pursuant to Section 6 of this Act. The applicant shall pay an application fee in the amount of Twenty-five pesos (P25) for every tree intended to be cut payable to the PCA. | http://www.pca.da.gov.ph/pdf/issuances/ra%208048.pdf | |

| Executive Order | Executive Order No. 213 | 2.000 | NULL | Constituting The National Enforcement Task Force On Coconut Tree Conservation | This aims to o ensure the preservation and development of the coconut industry, by constituting a national task force that will ensure effective and timely coordination among government agencies, local government units, and the private sector | The National Enforcement Task Force, hereinafter referred to as NETFORCE, is hereby constituted. The NETFORCE shall perform the following functions: a. Formulate plans of action to control the rampant cutting of coconut trees in violation of the provisions of RA 8048 and its implementing rules and regulations; b. Organize Regional Composite Teams composed of the member-agencies under the overall supervision of the Chief of the Philippine National Police to carry out and execute the plans of action. c.Establish such number of detachment stations and designate roving inspectors and patrols | https://www.officialgazette.gov.ph/2000/01/30/executive-order-no-213-s-2000/ | |

| Bill | House Bill No. 398 | 2.010 | 15th | An Act Establishing An Emergency Measure To Alleviate The Plight Of Coconut Farmers Adversely Affected By Low Prices Of Copra And Other Coconut Products, And Providing Funds Therefor, also known as the “Coconut Emergency Measures Act of 2010” | Due to the rapid and steep decline in copra prices, more farmers cut trees and sell them as lumber, instead of harvesting the coconut. In order to immediately address the abnormal price situtation in the cococnut industry sector brought by the worldwide glut of fats and oils in the world market, there is a need to launch an income supplement program for small coconut farmers, tillers, workers, and owner-cultivators. | Coconut farmers and coconut processing sector shall be provided Income Supplement projects for coconut farmers to sell their copra and husked nuts at millgate price or better, as follows: a. transport allowance b. marketing assistance c. direct buying of copra by the NFA at a base price determined by the PCA d. income support e. livestock and seedling dispersal f. information and trainings through DOST g. skills for efficient marketing h. help for acquisition of fertilizers | http://www.congress.gov.ph/legisdocs/basic_15/HB00398.pdf | |

| Bill | Senate Bill No. 2414 | 2.010 | 15th | An Act Amending Certain Sections Of Republic Act Number Six Thousand Six Hundred Fifty Seven (R.A. 6657), As Amended, Otherwise Known As The Comprehensive Agrarian Reform Law Of 1998, And For Other Purposes | This bill seeks, therefore, to alleviate the present condition of the coconut industry and ensure its continuity and substantially by classifying it as last priority for coverage in the Comprehensive Agrarian Reform Program of the government so as not to discourage coconut farmers in investing further in coconut farming. | SECTION 1. Section 7 of Republic Act Numbered Six Thousand Six Hundred Fifty Seven (R.A 6657), as amended, otherwise known as the “Comprehensive Agrarian Reform Law of 1998” is hereby amended to read as follows: “Section 7. Priority. – The Department of Agrarian Reform (DAR) in coordination with the Presidential Agrarian Reform Council (PARC) shall plan and program the acquisition and distribution of all agricultural lands through a period of ten (10) years from effectivity of this Act. Land shall be acquired and distributed as follows: Phase One: Rice and corn lands under Presidential Decree No. 27; All idle or abandoned lands; all private lands voluntarily offered by the owners for agrarian reform; all lands foreclosed by government financial institutions; all lands acquired by the presidential Commission on Good Government (PCGG); and all other lands owned by the government devoted to or suitable for agriculture, which shall be acquired and distributed immediately upon the effectivity of this Act, with the implementation to be completed within the period of not more than four (4) years. Phase Two: all alienable and disposable public agriculture lands; all arable public agricultural lands under agro-forest, pasture and agricultural leases already cultivated and planted to crop in accordance with Article XIII of the Constitution; all public agricultural lands which are to be opened for new development and resettlement; and all private agricultural lands in excess of fifty (50) hectares, insofar as the excess hectarage is concerned, to implement prinCipally the rights of farmers and regular farm workers, who are landless, to own directly or collectively the lands they till, which shall be distributed immediately upon the effectivity | https://www.senate.gov.ph/lisdata/100608624!.pdf | |

| Bill | House Bill No. 3917 | 2.011 | 15th | An Act Granting Subsidy To Coconut Farmers, also known as the “Coconut Farmers subdsidy of 2010” | This bill seeks to provide a threshold price of coconuts so that when the price plunges, the National Government will assume its role and alleviate the coconut farmers’ predicament. | When the price of coconuts go below the threshold level, the National Government thru the PCA shall assume the difference between the prevailing market price and the threshold price. The Authority shall ensure that only small-scale rice coconut farmers and coconut farmers with the annual income below the rural poverty threshold will be entitled to the benefits of this act. | http://www.congress.gov.ph/legisdocs/basic_15/HB03917.pdf | |

| Law | Republic Act No. 10593 | 2.012 | 15th | An Act Amending Certain Sections Of Republic Act No. 8048, Entitled “An Act Providing For The Regulation Of The Cutting Of Coconut Trees, Its Replenishment, Providing Penalties Therefor, And For Other Purposes” | The Act aims to amend the prohibitions in cutting coconut trees, amend the application fee for permit to cut, and to provide police powers to PCA to investigate suspected violations of this Act. | Amendment: Sec. 4. Prohibition.— No coconut tree shall be cut except in the following cases and only after a permit had been issued therefor: “(a) When the tree is sixty (60) years old in the case of tall varieties, and at least forty (40) years old for dwarf varieties; (c) When the tree is severely disease-infested and beyond rehabilitation; Sec. 5. Permit to Cut. – No coconut tree or trees shall be cut unless a permit therefore, upon due application being made, has been issued by the PCA pursuant to Section 6 of this Act. The applicant shall pay an application fee in the amount of One hundred pesos (P100.00) for every tree intended to be cut payable to the PCA. Section 7. A new Section 7 is hereby inserted after Section 6 of this Act, to read as follows: “SEC. 7. Police Powers. – The PCA shall be vested with the authority to exercise duly delegated police powers for the proper performance of its functions and duties” | https://www.senate.gov.ph/republic_acts/ra%2010593.pdf | |

| Bill | House Bill No. 1866 | 2.013 | 16th | An Act Prohibiting Resicada System In The Coconut Industry And For Other Purposes | This Act aims to abolish the Resicada System. “Resicada” is the amount deducted from the prices of copra by reason of its moisture content which exceeded the established standards. It has been established by traders into a scheme to decieve coconut farmers of the real value of their copra produce. | No amount shall be deducted from the prices of copra for reason that its moisture content exceeded the established standards. The buying proce of corpa in barangays, municipalities and provinces shall be in accordance with the latest price index of copra in the local and international markets as provided by the regional officies of the PCA. Municipal governments and barangay councils shall designate a place in their area where buying and selling copra shall be made. | http://www.congress.gov.ph/legisdocs/basic_16/HB01866.pdf | |

| Executive Order | Executive Order No. 179 | 2.015 | NULL | Providing The Administrative Guidelines For The Inventory And Privatization Of Coco Levy Assets | This seeks to prescribe administrative guidelines for the treatment of the Coco Levy Assets and the deposit of any privatization proceeds in the Special Account in the General Fund for Coco Levies (Coco Levy SAGF) to ensure that the Coco Levy Funds and Coco Levy Assets will only be utilized for the benefit of the coconut farmers and the Philippine coconut industry. | EO 179 requires the inventory, privatization and reconveyance and in favor of the government of all coconut levy assets, including but not limited to the shares of stock in the United Coconut Planters Bank (UCPB), Coconut Industry Investment Fund (CIIF) Companies and CIIF Holding Companies, as well as the 5,500,000 San Miguel Corporation shares registered in the name of the Presidential Commission on Good Government (PCGG). | https://www.officialgazette.gov.ph/2015/03/18/executive-order-no-179-s-2015/ | |

| Executive Order | Executive Order No. 180 | 2.015 | NULL | Providing The Administrative Guidelines For The Reconveyance And Utilization Of Coco Levy Assets For The Benefit Of The Coconut Farmers And The Development Of The Coconut Industry, And For Other Purposes | This seeks to prescribe administrative guidelines for the reconveyance and utilization of the Coco Levy Assets already declared by the Supreme Court as owned by the Government, to ensure that Coco Levy Assets will only be utilized for the benefit of the coconut farmers, and the Philippine coconut industry. | EO180 ordered the immediate transfer and reconveyance of the coconut levy assets to the government and use them for the Integrated Coconut Industry Roadmap and the Roadmap for Coco Levy. The PCA, in coordination with the Office of the Presidential Assistant for Food, Security, and Agricultural Modernization, is hereby directed to develop and submit the Roadmap, for the approval of the President. | https://www.officialgazette.gov.ph/downloads/2015/03mar/20150318-EO-0179-BSA.pdf | |

| Bill | House Bill No. 1369 | 2.016 | 17th | An Act Providing The Enabling Mechanisms For Research And Development Of Coconut Sugar In The Country And Appropriating Funds Therefor, also known as the “Coconut Sugar Research and Development Act” | This bill seeks to further boost the coconut industry in the country by providing the mechanisms to fund the research and development of cooc sugar to ensure this product’s conformity with internationally accepted standards for food and safety. It is hoped that this meqasure will improve the lives of the Filipino families who are directly and indirectly dependent on the coconut industry. | The Department of Science and Technology, in coordination with the Philippine Coconut Authority, Department of Agriculture, and the Food and Nutrition Research Institute, shall conduct an extensive R&D study on the health benefits and nutritional value of coconut sugar in order to develop the same and ensure its compliance with internationally accepted standards on food and safety. The Landbank of the Philippines is hereby mandated to formulate a Coconut Sugar Credit Facility and Loan Package Window, which shall extend tlow interest loans to small and medium enterprises seeking to venture into the business of promoting the consumption and utilization of coconut sugar. | http://www.congress.gov.ph/legisdocs/basic_17/HB01369.pdf | |

| Bill | House Bill No. 1370 | 2.016 | 17th | An Act Providing Coconut Husk Decorticating Facilities To Coconut Farmers, also known as the “Kasaganaan sa Niyugan Act” | This measure seeks to provide decorticating machines to small coconut farmers’ organizations and multi-purpose cooperatives in every coconut-producing municipality and city in the country to help them produce the desired quantity and quality of the coir fibers within a short period of time. | The Department of Agriculture shall provide low maintenance, high output mobile decorticating machines to small coconut farmers’ organizations and multi-purpose cooperatives in every coconut-producing municipality and city in the country. The amount of One Hundred Million is initially appropriated for the program. | http://www.congress.gov.ph/legisdocs/basic_17/HB01370.pdf | |

| Bill | House Bill No. 3947 | 2.016 | 17th | An Act Establishing The Coconut Research, Development And Extension Center In The Southern Luzon State University And Appropriating Funds Therefor | The bill aims to establish a Center based at the Southern Luzon State Universiyt (SLSU) which shall help catalyze the advancement of coconut research, development and extension to make the industry nationally productive and globally competitive. | This Act shall establish the Coconut Research, Development, and Extension Center. The Center shall be based in SLSU located at the Municipality of Lucban, Province of Quezon. The Center shall coordinate with the DA through the BAR, PCA. DOST, DTI, NEDA and PCARRD in training stakeholders, conducting researchers, extending technologies, adn analyzing demand and supply of coconut in the domestic and international market. | http://www.congress.gov.ph/legisdocs/basic_17/HB03947.pdf | |

| Bill | House Bill No. 6479 | 2.017 | 17th | An Act Establishing Quezon Coconut Research And Development Center In Catanauan, Quezon, also known as the “Quezon Coconut Research and Development Act of 2017” | This bill aims to establish a coconut research and development facility in Quezon, particularly in the Municipality of Catanauan, that will serve as the primary research institute for coconut production in the province. | There is hereby established the “Quezon Coconut Research and Development Center” in the municiplaity of Catanauan, Quezon that will serve as the province’s primary institute in conducting research on resilient coconut species, innovation of farming techniques, and development of coconut products. The DOST, DA, DTI, PCA, and the local government of the province of Quezon and Municipality of Catanauan shall enter into a multi-partite cooperation agreement to establish and issue the mandate and functions of the Center and integrate knowledge and capacility for the innovation of the coconut industry. | http://www.congress.gov.ph/legisdocs/basic_17/HB06479.pdf | |

| Bill | House Bill No. 8552 | 2.018 | 17th | An Act Further Strengthening The Philippine Coconut Authority (PCA), Amending For The Purpose Section 4 Of Presidential Decree No. 1468, Otherwise Known As The “Revised Coconut Industry Code”, As Amended | The bill seeks to strengthen the structure and the functions of the Philippine Coconut Authority by amending PD 1468, otherwise known as the “Revised Coconut Industry Code” | Section 4. Governing Board – The corporate powers and duties of the PCA shall be vested in and exercised by a Board of Fifteen members, as follows: I.) Six (6) members from the coconut farmers sector J) One (1) representative from the coconut processing industry sector PCA is hereby authorized to implement a reorganization plan to rationalize its staffing pattern, which shall include a dedicated unit for planning, evaluation of proposals, and monitoring of the implementation of programs and projects under the coconut farmers and industry development trust fund. | http://www.congress.gov.ph/legisdocs/third_17/HBT8552.pdf | |

| Bill | Senate Bill No. 1976 | 2.018 | 17th | An Act To Further Strengthen The Philippine Coconut Authority (PCA), Repealing PD No. 1468, Otherwise Known As The Revised Coconut Industry Code Of 1978, As Amended, also known as the “Strengthened Philippine Coconut Authority Law” | This bill aims to further strengthen the Philippine Coconut Authority and increase the representation of coconut farmers in the reconstituted PCA board that will ensure that the protection of farmers’ interest in the agency’s decision-making process. | Sec. 5 The corporate powers and duties of the PCA shall be vested in and exercised by a Governing Board. The Governing Board of the PCA is hereby reconstituted to be composed of 11 members. c. Six (6) representatives from the coconut farmers sector, 2 each for Luzon, Visayas, and Mindanao. The PCA shall formulate a coconut industry roadmap which shall be the basis of its performance and evaluation. | https://www.senate.gov.ph/lisdata/2851925129!.pdf | |

| Bill | Senate Bill No. 1913 | 2.018 | 17th | An Act To Further Strengthen The Philippine Coconut Authority, Repealing Pd No. 1468 Otherwise Known As The Revised Coconut Industry Code Of 1978, As Amended | This bill seeks to introducte an icnreased representation of coconut farmers in the reconstituted PCA board that will ensure that the protection of farmers’ interest in the agency’s decision-making process. | Sec. 5 The corporate powers and duties of the PCA shall be vested in and exercised by a Governing Board. The Governing Board of the PCA is hereby reconstituted to be composed of 11 members. c. Six (6) representatives from the coconut farmers sector, 2 each for Luzon, Visayas, and Mindanao. Sec. 4. The PCA shall execute a reorganization plan and create a dedicated unit for the planning, monitoring and evaluation of the CFITF funded programs and report annually their accomplishments and performance to both Houses of Congress and publish the same in the PCA website | https://www.senate.gov.ph/lisdata/2827624603!.pdf | |

| Bill | House Bill No. 255 | 2.019 | 18th | An Act Creating The Genuine Small Coconut Farmers’ Fund And For Other Purposes, also known as the “Genuine Small Coconut Farmers’ Fund Act of 2016” | This bill seeks to address the concern of small coconut farmers. It is meant to effect the return of the control of the coco levy funds to their rightful owners, the millions of small coconut farmers; providing therefor a mechanism so that their rights and interest to those funds shall be protected; and so that they may exercise their ownership rights over the funds and may dispose these as they see fit in line with the development of the local coconut industry. | All the funds established from the proceeds of the levies, including but not limited to the Coconut Investment Fund (CIF), the Coconut Consumers Stabilization Fund (CCSF), the Coconut Industry Development Fund (CIDF), the Coconut Development Fund (CDF), the Coconut Industry Stabilization Fund (CISF), the Coconut Reserved Fund (CRF) as well as all assets acquired or established therefrom – such as but not limited to the United Coconut Planters Bank (UCPB) established and/or acquired under PD 755, the Coconut Industry Investment Fund Companies (CIIFC), and all other assets acquired, established or set up using the coconut levy collections shall form part of a single fund which is hereby created to be known as the Genuine Small Coconut Farmers’ Fund (GSCFF). | http://www.congress.gov.ph/legisdocs/basic_18/HB00255.pdf | |

| Bill | House Bill No. 10 | 2.019 | 18th | An Act Declaring The Coconut Levy Assets As A Trust Fund, Providing For Its Management And Utilization, Authorizing The Privatization And Management Office To Dispose The Coconut Levy Assets, And For Other Purposes, also known as the “Coconut Farmers and Industry Trust Fund Act.” | This Act aims to make sure that the coconut farmers benefit from the coco levy fund; that more funds will be provided for infrastructure and research to strengthen the coconut industry, and efforts shall be supported to recover the remaining funds. | Reconstitutes the Philippine Coconut Authority to ensure the participation of coconut farmers in the crafting and implementation of the Coconut Farmers and Industry Development Plan ;Creates a Coconut Farmers and Industry Trust Fund which shall be capitalized, managed, invested, utilized and accounted for in the manner provided in this Act and shall be used for the benefit of the coconut farmers and the development of the coconut industry; Mandates the Designated Disposition Entities assigned by the Trust Fund Management Committee to privatized or disposed Coco Levy Assets subject to the regulatory approvals as required by law and to take title to and possession of, conserve, provisionally manage, and dispose the Coco Levy Assets which have been identified for privatization and disposition. | http://www.congress.gov.ph/legisdocs/basic_18/HB00010.pdf | |

| Bill | House Bill No. 166 | 2.019 | 18th | An Act Establishing The Coconut Farmers And Industry Development Trust Fund And Providing For Its Management And Utilization | This bill aims to let the coconut levy funds be utilized for the benefit of the coconut farmers and for the development of the coconut industry. | Seeks to create a trust fund to be maintained for a period not to exceed thirty (30) years or until the fund is fully utilized which shall be used exclusively for the ultimate benefit of coconut farmers and for the development of the coconut industry. Provides for a Ten Billion Pesos (Php 10,000,000,000.00) Jumpstart Fund which may be used within two (2) years commencing from the approval of the Plan by the President to jumpstart the development of the industry; Creates the Coconut Farmers and Industry Trust Fund Committee to coordinate and monitor the implementation of the Coconut Farmers and Industry Development Plan; Conducts complete accounting and inventory of all Coconut Levy Assets by the PCGG; Allows audit by the Commission on Audit on the inventory of the Coconut Levy Assets prepared by the PCGG; and allows privatization of non-cash coconut levy assets which shall be determine by the Governance Commission for Government-Owned or Controlled Corporations. | http://www.congress.gov.ph/legisdocs/basic_18/HB00166.pdf | |

| Bill | House Bill No. 2522 | 2.019 | 18th | An Act Creating The Coconut Industry Trust Fund, Providing For Its Management And For Other Purposes | This Act has the following objectives: a. Promote the steady, accelerated and orderly development and vertical integration of the coconut industry; b. Develop and establish coconut based farming systems including but not limited to the establishment of model coconut farms; c. Hasten and advance industrialization in the coconut industry and the diversification and proper utilization of coconut products and by-products; d. Promote the effective utilization and marketing of coconut products and by-products in the domestic and foreign markets and preserve the competitiveness and reliability of the country as a major producer and supplier of said products; e. Increase production by expanding the planting and replanting progrma of coconut trees in strategic areas identified as having the most potential; f. Conduct scientific researches and investigations in all areas pertaining to the agricultural, industrial, marketing and socio-economic aspect of the coconut industry and encourage the participation of small holder farmers in research and technology; g. Encourage and promote organization of coconut farmers’ cooperatives, associations and organization and provide them grants, credits and financing schemes; and h. Generate and disseminate information and communication to farmers, producers, and other sectors to ensure the appreciation and adoption of appropriate technology and practices, inventions, as well as the proper awareness and correct underswtanding of issues and development in the coconut industry | There is hereby created a trust fund to be known as the Coconut Industry Trust Fund (CITF) from the funds and assets of the so-called coconut levy funds consisting of the 753,848,312 CIIF Preferred SMC shares and their accumulated dividends. There is hereby created under the Office of the President of the Philippines, the Philippine Coconut Welfare and Industry Development Corporation which shall manage, administer, utilize, or dipose certain assets of the CITF. | http://www.congress.gov.ph/legisdocs/basic_18/HB02522.pdf | |

| Bill | House Bill No. 2549 | 2.019 | 18th | An Act Establishing The Coconut Farmers and Industry Development Trust Fund, Providing For Its Management And For Other Purposes, also known as the “Coconut Farmers and Industry Development Trust Fund Act” | Estimates by the PCA show that there are 3.5 million coconut farmers who are among the nation’s poorest. This is why it is high time to resolve the issues on the Coco Levy Fund that was supposed to be utilized for the development of the coconut industry. | Coconut Levy Funds refer to any and all kinds of property, whether real or personal, tangible or intangible, wherever situated, which have been acquired through or otherwise funded by the Coconut Levy Funds. There is hereby created a trust fund to be maintained for a period not to exceed thirty (30) years or until the fund is fully utilized to be known as the Coconut Farmers and Industry Development Trust Fund, which shall consist of the Trust Principal and Trust Income. | http://www.congress.gov.ph/legisdocs/basic_18/HB02549.pdf | |

| Bill | House Bill No. 2552 | 2.019 | 18th | An Act Establishing The Coconut Farmers And Industry Development Trust Fund And Providing For Its Management And Utilization | This bill seeks to address the decades-long struggle of coconut farmers by enacting a genuine law on the use of the coconut levy funds. It is meant to provide a mechanism to protect the rights, welfare, and interest of the small and marginalized coconut farmers and farm workers. | Coconut Levy Funds shall refer to various funds generated from leives, taxes, charges, and other fees exacted or imposed pursuant to or in connection with the sale of opra rececada or its equivalent in other coconut products, and collected for the most part from coconut farmers, planter, millers, refiners, processors, exporter, dessicators, and other end-users of copra rececada or its equivalent in other products. There is hereby created a trust fund to be maintained for a period not to exceed thirty (30) years or until the fund is fully utilized to be known as the Coconut Farmers and Industry Development Trust Fund, which shall consist of the Trust Principal and Trust Income. | http://www.congress.gov.ph/legisdocs/basic_18/HB02552.pdf | |

| Bill | House Bill No. 854 | 2.019 | 18th | An Act Declaring The Coconut Levy Assets As A Trust Fund, Providing For Its Management And Utilization, Authorizing The Privatization And Management Office To Dispose The Coconut Levy Assets, And For Other Purposes, also known as the “Coconut Farmers and Industry Development Act” | This bill aims to create a permanent trust fund for the Coco Levy Fund to be utilized for the development of the coconut industry to improve productivity and diversification of the coconut industry, which can effectively translate to a better quality of life of our coconut farmers. | Coconut Levy Funds shall refer to various funds generated from leives, taxes, charges, and other fees exacted or imposed pursuant to or in connection with the sale of opra rececada or its equivalent in other coconut products, and collected for the most part from coconut farmers, planter, millers, refiners, processors, exporter, dessicators, and other end-users of copra rececada or its equivalent in other products. The Coconut Levy Assets are hereby declared as a trust fund to be known as the “Coconut Farmers and Industry Trust Fund” | http://www.congress.gov.ph/legisdocs/basic_18/HB00854.pdf | |