Native Chicken Industry Profile

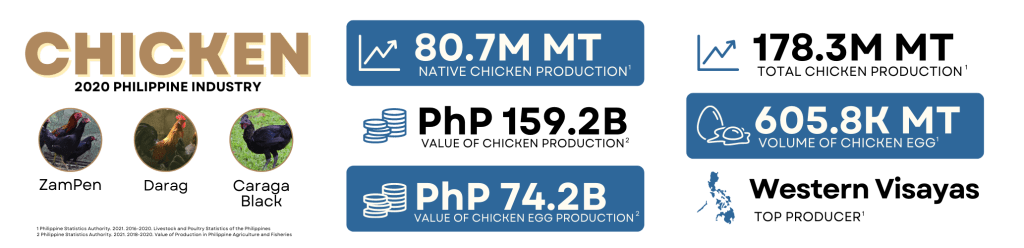

The Philippine native chicken recorded an 80.7 million inventory in 2020, which accounted for 45% of the country’s total chicken inventory. Western Visayas (Region VI) is the top producer with 12.4 million native chickens, followed by Northern Mindanao (Region X) with 9.7 million native chickens. Native chicken industry provides livelihood in terms of food security, additional income, utilization of farm wastes and by-products, and fulfillment of other socio-cultural obligations. It also allows participation of rural poor in the production of high quality chicken products that are paid at premium prices.

There is a significant demand for native chicken as it has established its niche market. Native chickens are either sold live or dressed in markets. The main products from native chickens are their eggs and meat, which are both perceived as healthier options and dependable sources of protein. Native chicken has a distinct savory taste, and lean and finely textured meat. With the shifting of consumer preferences toward organic and naturally produced products, native chicken has a growing market as they are relatively high-tolerant to diseases which require minimal to no use of antibiotics and free from other synthetic chemical residues.

The Philippine chickens are usually named after their locality. Boholano, Camarines and ZamPen are from the provinces of Bohol, Bicol and Zamboanga Peninsula, respectively, while Darag is the native chicken of Panay Island, Western Visayas.

Problems in the Industry

The Philippine native chicken industry faces the issues of unselected native chicken population in other native chicken key areas, high costs of inputs, limited native chicken meat and egg product and packaging innovations, and limited information on functional nutrients as healthier food options.

ISP for Native Chicken

reduced mortality rate to 20% per cycle, and has established native chicken conservation farms in WVSU, WMSU, JHCSC and SRPPF. Going forward, Native Chicken ISP aims to increase average egg production,

reduce mortality, increase the number of slaughtered native chicken produced, and establish privately operated native chicken breeder farms.

Strategic R&D

Strategic R&D is DOST-PCAARRD’s banner program comprising all R&D activities that are intended to

generate outputs geared towards maximum economic and social benefits

Establishment of Sustainable Selection, Breeding, and Hatchery operation for Darag Native Chicken production

The objectives of this project are to develop a native chicken breeding and hatchery management system that would ensure stable...

Read MoreEstablishment of ZamPen Native Chicken Breeding Population with Improved Egg Production and Growth Performance

This proposed R&D project envisions to establish a ZamPen native chicken breeding population with improved egg production and growth performance....

Read MoreDevelopment of Caraga Black Native Chicken through Selection and Breeding as Potential Niche Product of Caraga Region

With the development of Caraga Black native chicken, it can strengthen its capacity and capability in terms of productivity and...

Read MoreAccelerated R&D Program NICER

The program, which has 3 projects, aims to establish an R&D center for native chickens in Region 9 that is...

Read MoreTechnologies

Products, equipment, and protocols or process innovations developed to improve productivity, efficiency,

quality, and profitability in the agriculture and aquatic industries, and to achieve sustainable

utilization and management of natural resources

Artificial Insemination

This proposed project aspires to test and validate the artificial insemination (AI) technology as a tool in enhancing the reproductive efficiency of Philippine native chickens and develop semen processing and...

Read MoreCapacity Building

Capacity building efforts of DOST-PCAARRD seek to develop and enhance the R&D capabilities of researchers

and academic or research institutions through graduate assistantships & non-degree trainings

and development and/or upgrading of research facilities

Policy Research & Advocacy

Analysis of policy concerns and advocacy of science-informed policies ensures that the AANR policy environment is conducive for S&T development

and investments

Competitiveness of Philippine Native Chicken Industry under the ASEAN Economic Community

The study shows that the Philippine native chicken failed to be competitive in both export trade and import substitution scenarios. In other words, its level of competitiveness is way below the ability to export at par with other exporters. The cost of producing native chicken in the Philippines is also much higher relative to its competitors abroad.

For the industry to be import competitive, a 50 percent decrease in the domestic content of native chicken is warranted. The domestic content requirement is the minimum percentage of domestically-sourced inputs used to produce such product. Decreasing this requirement would allow our local farmers to source less expensive inputs from other countries, therefore, improving the industry’s price competitiveness.

Reference:

Valientes, R.M. and Cruz, M. B. (2017). ASEAN Economic Community: Opportunities and Challenges for the Livestock and Forestry Sectors. Los Baños, Laguna, Philippines: Philippine Council for Agriculture, Aquatic and Natural Resources Research and Development – (Project Report)

Market Advisory

Market-related advisory services that are product of market scanning done by continually and actively monitoring the external environment in order to identify customer needs, anticipate competitive actions, and, identify technological changes which may provide new market opportunities or market disruptions. The advisories provide a variety of information, including selection of market outlets, emerging demand, technological advances, and potential business partners, among others.

To be able to run their business as a modern venture, clients will be provided with information to adapt/respond to market change based on changing market conditions and opportunities. The emerging demand/trends may have direct effect on both demand for skills improvement and the competencies needed to promote market-oriented enterprises.

Philippine Chicken Industry Update: Market Trends, Projected Shortages, Rising Imports,

Explore the dynamics behind the current status of the country’s...

Read MoreBird Flu Alert, Rabies Outbreak, and Swine Industry Initiatives

Livestock and poultry face threats from bird flu and rabies...

Read MoreRecent Measures in Livestock and Poultry Management: Bans, Price Controls,

Recent developments in Philippine swine and poultry management, covering poultry...

Read More