In this Article

The Philippine government is observing falling farmgate, wholesale, and retail rice prices alongside stable production levels in early 2025. This advisory examines national and local market trends, presents key data on imports and harvest performance, and highlights strategic R&D initiatives to improve rice productivity and resilience through biotechnology and sustainable farming practices.

Source: PhilStar

Rice Price Trends in Distribution Channels

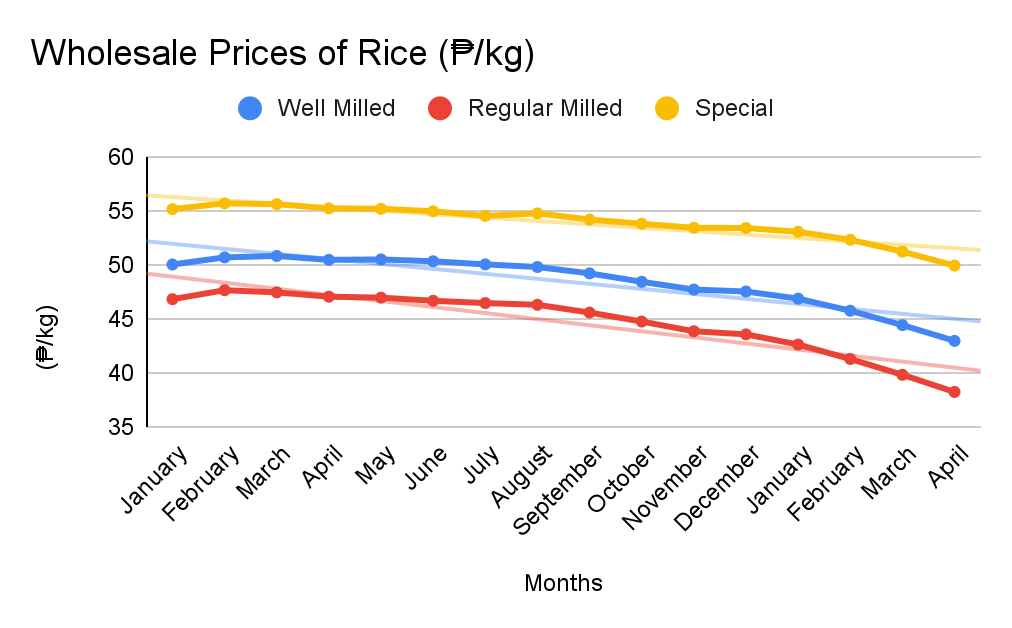

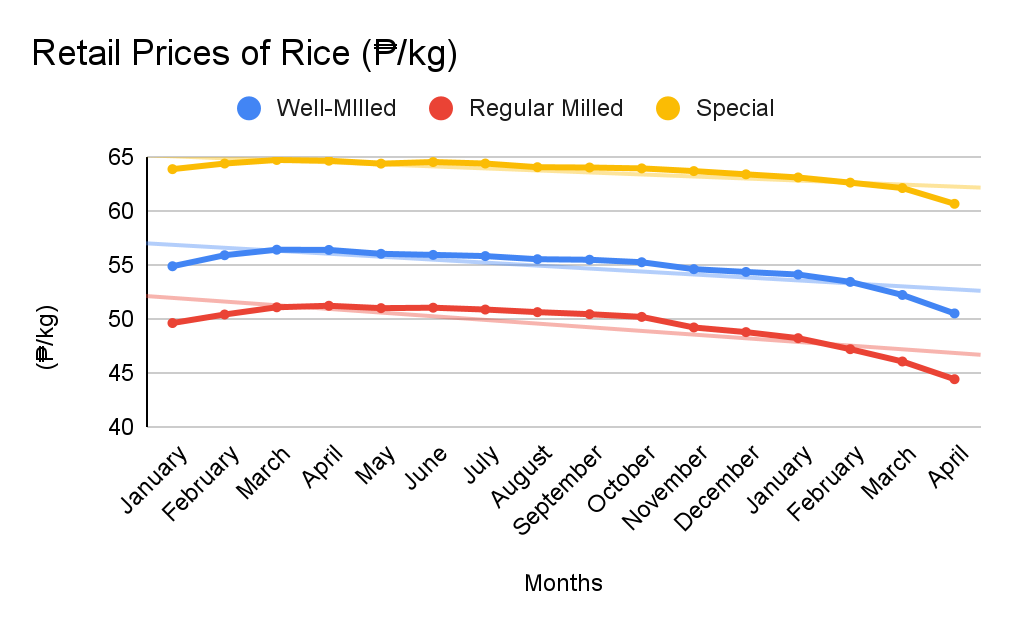

Recent data from the Philippine Statistics Authority (PSA) showed a consistent downward trend in average rice prices throughout all market levels in early 2025 (Figure 1). In wholesale markets, prices dropped between April 2024 and April 2025, with declines ranging from 10% to 19%. Regular Milled rice experienced a substantial decrease, while Special Rice maintained its position as the premium-priced variety despite the decrease in the overall market.

At the retail level, consumers experience price reductions of 6% to 13% in all rice varieties. This trend was confirmed at Batong Malake Public Market in Los Baños, Laguna (validation market). The prices for special rice decreased from ₱57/kg to ₱56/kg, Well-milled rice from ₱55/kg to ₱53/kg, and Regular-milled rice from ₱47/kg to ₱46/kg.

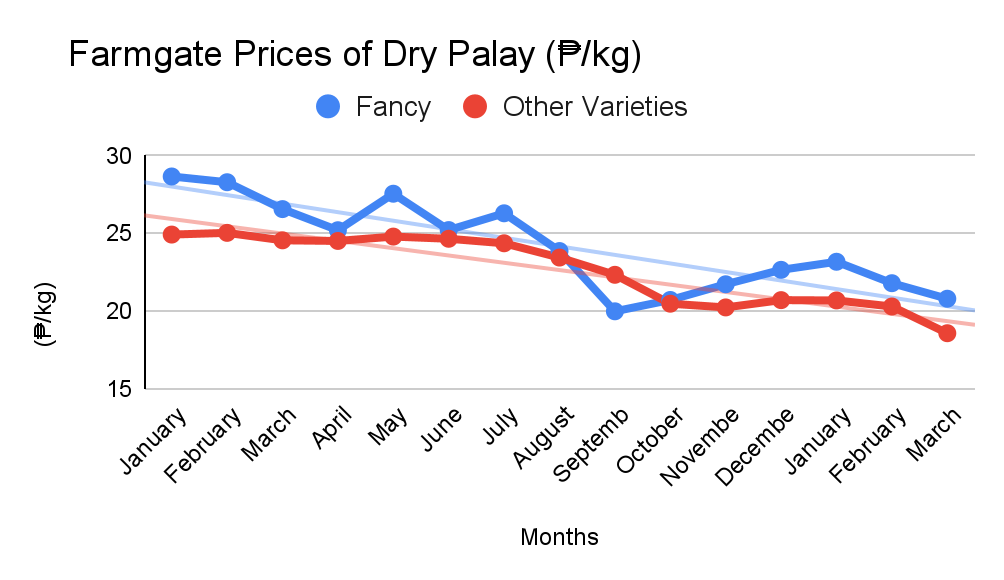

The most significant price decline occurred at the farmgate level, where the average price of dry palay (unmilled rice) declined notably between March 2024 and March 2025 (Figure 2). Prices of Fancy varieties dropped by approximately 23%, while other varieties declined by about 20% over the same period. Although Fancy palay consistently has higher prices throughout the year, the gap tightened significantly toward the end. The price movement may be attributed to the increase in palay productivity during the same period, as highlighted in PSA’s report for the first quarter (Q1) of 2025. The rise in yield per hectare suggests that an increase in effective supply, holding all other factors constant, may have exerted downward pressure on farmgate prices.

Table 1. Summary of Price Trend of Rice at Different Price Levels, March 2024- 2025

| Item | March 2024 | March 2025 | % Difference |

| Farmgate Prices | |||

| Fancy | 26.56 | 20.79 | (↓) -21.72% |

| Other Varieties | 24.55 | 18.57 | (↓) -24.36% |

| Wholesale Prices | |||

| Rice Special | 55.66 | 51.26 | (↓) -7.91% |

| Rice Premium | 54.47 | 47.58 | (↓) -12.65% |

| Well-Milled Rice | 50.86 | 44.46 | (↓) -12.58% |

| Regular-Milled Rice | 47.49 | 39.86 | (↓) -16.07% |

| Retail Prices | |||

| Well-Milled Rice | 56.44 | 52.25 | (↓) -7.42% |

| Regular Rice | 51.11 | 46.09 | (↓) -9.82% |

| Special Rice | 64.75 | 62.15 | (↓) -4.02% |

Source: OpenSTAT, 2025

Production and Trade Updates

According to PSA reports released on May 1, 2025, the Q1 palay production reached 4.69 million metric tons (MT), which represents a marginal 0.2% increase from the 4.68 million MT produced in Q1 2024. While the harvested area decreased by 1.7%, the overall yield per hectare (ha) increased by 2.3% (Table 2), reaching an average of 4.09 MT/ha. This growth reflects improvements in productivity, with both irrigated and rainfed palay contributing, with irrigated palay increasing by 1.7%, and rainfed palay by 3.7%. The rise in yield, despite reduced area, may have contributed to the increase in market supply, helping to explain the downward pressure observed in farmgate prices.

Table 2. Rice Production, Harvest Area, and Yield, Q1, 2024-2025

|

Item |

Q1 2024 |

Q1 2025 |

Percentage Change (%) |

|

Total Palay Production |

4.68 million MT |

4.69 million MT |

(↑) 0.2% |

|

Irrigated Palay |

3.60 million MT |

3.66 million MT |

(↑) 1.7% |

|

Rainfed Palay |

1.00 million MT |

1.04 million MT |

(↑) 3.7% |

|

Harvest Area |

1.17 million ha |

1.15 million ha |

(↓) –1.7% |

|

Irrigated Palay Area |

822,681 ha |

820,394 ha |

(↓) –0.3% |

|

Rainfed Palay Area |

351,953 ha |

327,130 ha |

(↓) –7.0% |

|

Average Yield |

4.00 MT/ha |

4.09 MT/ha |

(↑) 2.3% |

Source: OpenSTAT, 2025

Rice import arrivals reached 1.08 million MT as of mid-April 2025, representing a decline compared to the 1.19 million MT imported during the same period in 2024, according to the Bureau of Plant Industry (BPI). This slowdown is attributed to the anticipated recovery of local palay production and favorable weather conditions. Vietnam continues to be the leading rice supplier, accounting for over 900,000 MT of the total imports, with Thailand, Pakistan, Myanmar, and India providing the other supplies. The BPI has issued 2,359 sanitary and phytosanitary import clearances (SPSICs) for 1.89 MMT of rice, indicating additional future arrivals that may still influence the local market dynamics. The Department of Agriculture (DA) aims to restore palay output to record levels, projecting a 2025 harvest of 20.46 million MT, up from 19.09 million MT in 2024. Improved domestic output is expected to reduce the country’s dependence on imported rice.

Research Innovations

Mutant Rice Strain

A new mutant rice strain, 11NB10, has been developed by the Philippine Rice Research Institute (PhilRice) in collaboration with the DA’s Crop Biotechnology Center, Central Luzon State University, and Nagoya University. The variety features an enhanced root system and efficient carbohydrate allocation—traits linked to improved nutrient uptake, drought tolerance, and stress resilience. According to project leader Dr. Nonawin Agustin, identifying the genes responsible for these traits paves the way for breeding rice varieties that are better suited to challenging environments, including phosphorus-deficient and drought-prone soils.

As of May 2025, 11NB10 remains under research and field trials and is not yet commercially available. It must still undergo further testing and regulatory evaluation before release. Meanwhile, PhilRice continues to advance rice innovation, recently introducing 14 new inbred and hybrid varieties and launching GAP-certified “GAPproved Rice” under the RiceBIS 2.0 program. These efforts underscore the country’s commitment to enhancing food security through science-based and climate-resilient technologies.

DOST-PCAARRD Initiatives

The Department of Science and Technology – Philippine Council for Agriculture, Aquatic and Natural Resources Research and Development (DOST-PCAARRD) funded a project to strengthen intellectual property (IP) management and accelerate the commercialization of research and development (R&D) outputs, including rice-related technologies in Bohol. Implemented by Bohol Island State University (BISU) and led by Dr. Angeline D. Baldapan-Elegio, the project concluded in June 2023, focusing on patent mining and landscaping. This development in intellectual property management in the country aims to advocate for changes in the prioritization of R&D and technology transfer in the agriculture, aquatic, and natural resources (AANR) sector, by identifying gaps associated with specific technology areas and addressing these by extracting, processing, and analysing relevant information from patent documents.

Aside from IP asset inventory and capacity-building for researchers and staff of BISU’s Intellectual Property and Technology Business Management (IP-TBM) Unit, the project also established internal protocols, produced promotional materials, and engaged with potential adopters and business groups to explore commercialization partnerships.

By aligning public research with technology transfer mechanisms, the project contributes to a more innovation-driven agricultural sector. Strengthened IP systems empower universities like BISU to protect and manage valuable research outputs. Through structured commercialization pathways and industry linkages, technologies are more effectively brought from the laboratories to the hands of potential users and adopters. This ensures that government R&D investments generate a meaningful impact by supporting farmers’ productivity, promoting local innovation, and enhancing the competitiveness of the country’s rice industry.

Two other ongoing DOST-PCAARRD-funded research initiatives previously featured (access article through this link: https://tinyurl.com/AABHMarketAdvisory022) strengthen rice production through improved drought tolerance and sustainable field practices. One of the projects, led by PhilRice, investigated the molecular mechanisms behind rice root development under water stress. The team identified key genes involved in root growth and optimized hydroponic screening methods to accelerate the breeding of drought-tolerant rice varieties.

In a separate effort, the University of the Philippines Los Baños (UPLB), led by Dr. Pearl Sanchez, piloted the use of Trichoderma technology for on-site composting of rice straw. Conducted in Siniloan, Laguna, the project promotes soil health, reduces dependence on chemical fertilizers, and improves rice yields, offering a sustainable alternative to traditional rice straw disposal.

Market Outlook and Implications

Rice prices are expected to remain relatively stable in the near term, following consistent declines across farmgate, wholesale, and retail levels from March 2024 to March 2025. Modest gains in domestic palay production, improved average yields, and a slowdown in rice import arrivals in early 2025 have helped ease supply-side pressures and moderate price volatility.

Despite the slight increase in palay output, higher productivity likely expanded supply and contributed to the drop in farmgate prices. While government procurement at ₱18/kg to ₱24/kg offers some price support, its limited scale may not be sufficient to protect most farmers. Moreover, the 2,359 SPSICs issued for nearly 1.9 million MT of rice point to substantial future imports, which, if not timed carefully with domestic harvests, may further depress prices and strain farmer incomes.

For consumers, lower market prices provide short-term relief. However, sustaining this balance will require investments in climate-resilient technologies, improved market coordination, and stronger institutional support to ensure that rice price stability benefits both producers and consumers without compromising the long-term resilience of the rice sector.

References:

Arcalas, J.E. (2025, May 1). Palay harvest remains flat in Q1. PhilStar. Retrieved May 1, 2025 from https://www.philstar.com/business/2025/05/01/2439542/palay-harvest-remains-flat-q1

N.A. (2025, April 24). ‘Mutant’ rice strain developed. The Manila Times. Retrieved April 24, 2025 from https://www.manilatimes.net/2025/04/24/business/agribusiness/mutant-rice-strain-developed/2097758

Mencias, E. (2025, April 10). Presyo ng bigas sadsad sa P40 per kilo. Abante News Online. Retrieved April 10, 2025 from https://www.abante.com.ph/2025/04/10/presyo-ng-bigas-sadsad-sa-p40-per-kilo/

Pelonia, A. (2025, April 24). Rice import arrivals breach 1 million MT as of mid-April. Business Mirror. Retrieved April 24, 2025 from https://businessmirror.com.ph/2025/04/24/rice-import-arrivals-breach-1-million-mt-as-of-mid-april/