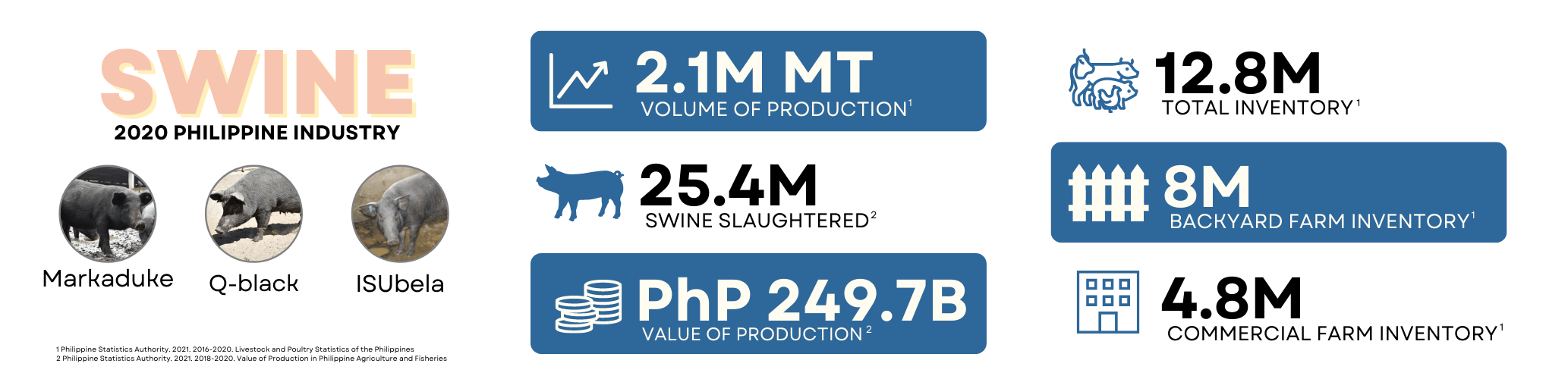

Swine Industry Profile

The Philippine swine industry is participated by players through various levels and sectors. These include the input sector (breeders, and feeds and pharmaceutical suppliers), farm sector, and processing sector. Two general farm types are present in the country – backyard and commercial farms. Backyard farms usually have 1 to 20 adult hogs, 1 to 10 adult hogs with 1 to 21 young hogs, or 1 to 40 young hogs. Commercial farms, on the other hand, have more than 20 adult hogs or more than 10 adult hogs with at least 22 young hogs or more than 40 young hogs. Unlike backyard hog farms, commercial hog farms are usually backward integrated and produce their own feeds for production. In 2015, 64 percent of the national swine inventory was contributed by backyard farms, with the remaining 36 percent sourced from commercial. Based on data from the Philippine Statistics Authority (PSA) as of 2019, the top swine-producing provinces in the country are Bulacan, Batangas, Bukidnon, Tarlac, and Rizal. Based on data from the Philippine Statistics Authority (PSA) as of 2019, the top swine-producing provinces in the country are Bulacan, Batangas, Bukidnon, Tarlac, and Rizal.

Problems in the Industry

With the continuously increasing demand for pork, there is a constant struggle to supply feeds for swine production. However, production of corn, which is a main source of feed for pigs, is still yet to catch up with the demand. Thus, the swine inputs sub-sector has become highly dependent on importing feed ingredients, as well as health and veterinary materials. This results in higher input prices, which is eventually reflected in the retail prices of pork and its derivative products. Another issue being faced by the swine industry is the prevalence of the African Swine Fever (ASF), which is a serious viral disease affecting swine with almost 100% fatality rate. The Philippines confirmed its first ASF outbreak in July 2019 with cases coming from Luzon, Mindanao, Leyte, and Samar Islands. Several reports have also stated the presence of ASF from wild pigs/boars residing within the forests of Malibcong Municipality and Kalinga Province. Through Proclamation No. 1143 s. 2021, the country was declared to be in a state of calamity due to the drastic increase in ASF cases. As of May 2021, ASF has spread to 12 regions, 46 provinces, 493 cities and municipalities, and 2,561 villages.

Data Source: Philippine Statistics Authority update as of May 30, 2024.

Data Source: Philippine Statistics Authority update as of May 30, 2024.

Data Source: Philippine Statistics Authority update as of May 30, 2024.

Swine Policies

Swine Programs

ISP for Swine

DOST-PCAARRD, through the Swine ISP, supports R&D initiatives aimed at addressing the current problems in the swine industry, developing technologies and systems that are expected to improve productivity and production efficiency, and creating new opportunities to increase the overall competitiveness of the Philippine swine industry.