Coffee

Industry Strategic Science and Technology Program

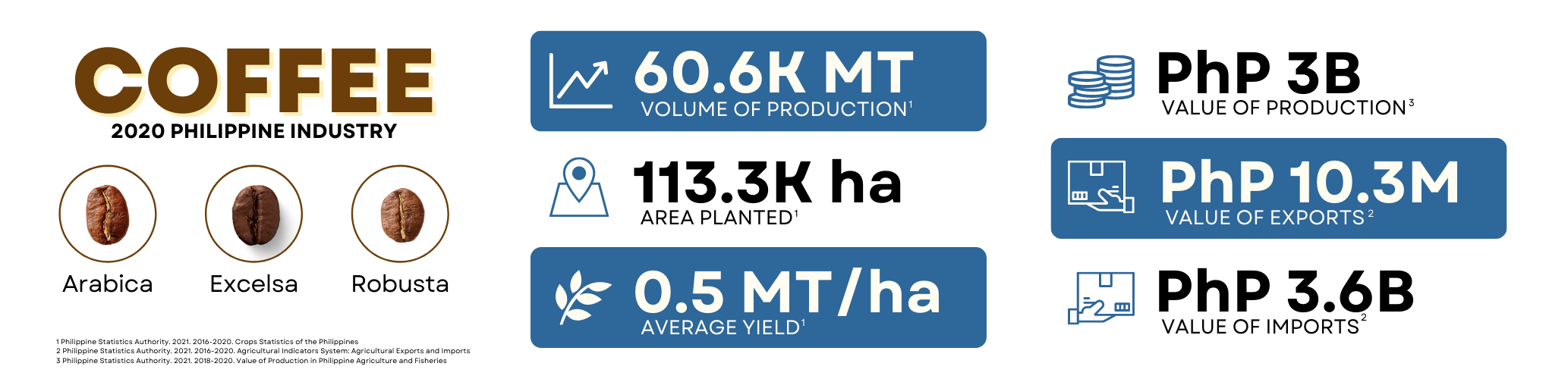

Coffee Industry Profile

Coffee has been a valuable segment of the Philippine economy. The Philippines became the 4th largest exporter of coffee in 1880, but coffee leaf rust destroyed the farms in 1894.

The Philippines is one of the few countries that can produce the four types of coffee: Robusta, Arabica, Liberica (Barako), and Excelsa. Arabica is the flavor variety and is mostly used as premium or gourmet coffee; Robusta is used as a blender to Arabica as well as in instant coffee. Liberica or Kapeng Barako has rich and intense taste and is best served black. The most common type is Robusta, which accounts for about 70 percent of total coffee production. Coffee is sold as green, roasted, or ground beans, and as soluble instant coffee.

The proliferation of local and foreign coffee stores (e.g. Starbucks, Figaro, etc.) and brands (e.g. Nestle, Cafe Amadeo, etc.) is a strong indication of its rising demand in the marketplace. However, failure to meet this growing demand is a problem within the industry, especially with a 0.2% annual decline in coffee volume over the past 10 years (PSA, 2018).

According to Philippine Statistics Authority (PSA), national production of 60,640.95 metric tons (MT) dried cherries in 2020 was not even enough to supply local demand, which was estimated at 198,720 MT. The country imports coffee to meet local demand. Average productivity in 2021 is 0.54 MT dried cherries/ha.

Problems in the Industry

The development of the industry is hampered by insufficient quality planting materials (high yielding) for expansion and replanting areas, low yield, and low quality beans. Low yield is due to: mismatch between the variety planted and environmental conditions, limited information on nutrient and water status, and occurrence of pests. Rising temperature due to climate change also threatens the industry as it might reduce the areas suitable for coffee growing, bring drought, increase the range of diseases and kill insects that pollinate coffee plants.

Coffee Policies

| Policy Type | Policy Number | Policy Year | Congress | Policy Title | Policy Description | Policy Objective | Policy Link | Commodity | Classification | info_encoder_stamp | info_date_stamp | info_quashing_remarks | filepath |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bill | House Bill No. 10915 | 2024 | 19th | An Act Establishing A System For Certifying Single Origin Coffee Produced In The Philippines And For Other Purposes | Coffee cultivation in the Philippines began in the late 18th century, introduced by Spanish missionaries. Over time, Filipino farmers adapted their practices to diverse climatic conditions, leading to the development of a rich coffee tradition. By the 19th and early 20th centuries, the Philippines had become a prominent global coffee producer. However, challenges such as coffee rust disease and increasing international competition led to a decline in production. Recently, there has been a renewed focus on specialty coffee, sparking interest in local coffee varieties. | This bill aims to establish a certification system for single origin coffee produced in the Philippines. Single origin coffee, which is sourced from a specific location, offers unique flavors linked to the region's environmental conditions. This concept is central to the specialty coffee industry, where traceability and quality are highly valued. Studies indicate that single origin coffees can achieve market premiums due to their distinctive taste and authenticity. For instance, research published in the Journal of Coffee Research shows that single origin coffees can command premiums of up to 30% over blended coffees. | https://docs.congress.hrep.online/legisdocs/basic_19/HB10915.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 9928 | 2024 | 19th | An Act Establishing A National Program For The Development Of The Philippine Coffee Industry, Creating For The Purpose The Philippine Coffee Council, And Appropriating Funds Therefor | The Philippine coffee industry holds immense potential for economic growth, social development, and environmental sustainability. Coffee has been an integral part of Philippine culture and history for centuries. However, the development of the industry has faced significant obstacles, such as but not limited to, limited access to markets and technology. By employing a whole-of-government approach, this measure seeks to unlock the full potential of the Philippine coffee industry. By doing so, the Philippine coffee industry will transform itself into a significant player in both the domestic and internationaL markets. More importantly, this will allow the Philippines to showcase the historical and cultural relevance and contribution of coffee to Filipino life. | This bill aims to achieve the following objectives: a. To fomulate strategies and craft action plans, following the value and supply chains analysis from farm to market that will provide direction for an enhanced and sustainable growth of the Philippine coffee industry; b. To integrate and harmonize programs, projects, and activities of government agencies and the private sector supportive of the short, medium and long-term agenda of the coffee industry; c. To promote Philippine coffee in the local market and in the international market; d. To uplift the welfare and increase the income of the country's smallholder coffee farmers, producers, processors, roasters, and retailers including their dependent families and thereby attain the goal of inclusive growth; e. To create a proactive and responsive national implementing arm that will ensure and monitor the focused development of the coffee industry guided by the Philippine Coffee Industry Roadmap and subsequent program extension and development plans involving the coffee industry; and f. To harness and enhance existing participatory mechanisms to ensure full engagement of various stakeholders in the development of the coffee industry. | null | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 9830 | 2024 | 19th | An Act Creating The National Coffee Development Authority For The Modernization Of The Philippine Coffee Industry And Appropriating Funds Therefor | The Philippines used to be a top exporter of coffee, but through the years this has changed for lack of comprehensive and viable plan and actions, as well as minimum support from concerned government agencies. Local coffee production is decreasing by 3.5% per year over the past 10 years, when the Philippine's consumption from 2018-2020 increased by 2.1.%. In 2015, the Philippines occupy the 30th slot among coffee producers in the world, but further slid to the 34th slot in 2020. The production value of coffee in the Philippines from 2012-2022 (in billions of Philippine pesos) amounted to the following: In 2022, the value of coffee produced in the Philippines amounted to around Php 3.37 billion, indicating an increase from the previous year. In the same year, the total coffee consumed by Filipinos amounted to 3.31 million 60-million-kilogram bags. Percent share in area planted to coffee by region (2020) was 113, 264.89 has. The top five regions with the biggest planting area for coffee in the last five years ago are as follows: SOCCSKARGEN, 27,010.25 ha; Davao Region,15, 881, 29 ha; ARMM,13, 976,ha; CALABARZON,13,196 ha.; and Northern Mindanao,11, 639.41 ha. There is a need to focus on the production andmodernization of the Coffee Industry in the Philippines if the country is to increase its production and be able to be globally competitive . For this reason, this presentation proposes the Creation of the National Coffee Development Authority that will, among others, promote the coffee industry in order to address not only the shortage of domestic coffee supply but be able to create a niche in the worldwide market for high value cash crop. | This bill seeks to promote and enhance the production of the coffee industry in the country with the aim of having an import-substitution to export substitution of coffee in the global market. Approximately 81% of all coffee requirements in the Philippines is imported. | null | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 9340 | 2023 | 19th | An Act Developing The Coffee Industry Of The Philippines And Creating The Coffee Industry Advancement And Research Center And Declaring The Province Of Sultan Kudarat As The Coffee Capital Of The Philippines | Notably, the Philippines, with a rich history of coffee cultivation, continues to be a key player in the global coffee landscape. In 2021, SOCCSKSARGEN, with its substantial coffee production, played a crucial role. It produced 21,007.41 metric tons of dried cherries (MT DC) and 10,503.71 metric tons of green coffee beans (MT GCB), 35.60 percent of the entire country's coffee production. Sultan Kudarat alone provided 18,044.46 MT DC and 9,022.23 MT GCB, 85.90 percent of the region and is the highest coffee producing province in the country. Through extensive research and development, the center will also focus on post-harvest technologies, pest management, and other critical areas of coffee cultivation. It will facilitate the transfer of knowledge, technical training programs, and collaboration among stakeholders to foster innovation and best practices in coffee production. | This bill seeks to revitalize and strengthen the Philippines' coffee industry. It recognizes the importance of research, development, and innovation in sustaining a vibrant coffee culture and generating economic opportunities for coffee farmers and stakeholders. | null | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 3552 | 2022 | 19th | An Act Establishing A National Program For The Coffee Industry Providing Funds Therefor And For Other Purposes | We are a nation of coffee drinkers. It is an undeniable fact that coffee has become a staple beverage among Fillpinos. From consumer drinks from your favourite coffee shop chain, to high-class brews from specialty stores, to 3-in-1 coffee mixes sold by the packet — the demand for coffee bisects the class divide and coffee drinkers come from all over the economic spectrum. In a research study from Kantar Woridpanel Philippines, a company specializing in consumer knowledge and insights based on continuous consumer panels, it was found out that Filipinos shifted from being moderate to heavy coffee drinkers. Filipinos are buying coffee products close to twice a week, or about 81 times a year, spending an average of P22 per shopping trip. Heavy coffee buyers, on the other hand, buy close to thrice a week, or 126 times in a year, spending an average of P28 per shopping trip. Tracking the shopping behavior of 3,000 households across the country from June 2014 to June 2015, it was discovered that 30% of beverage allowance is spent on coffee. For being a nation filled with coffee drinkers, it is saddening to know that the local coffee industry, from coffee growers, processors and traders, is in such a sorry state. The Philippines produces around 30,000 metric tons of coffee per year but local demand is for 100,000 metric tons. Local supply cannot fulfill local demand that we have to import coffee just to meet it. Our coffee production ranks us 110th in the world in terms of output. For comparison, our South East Asian neighbor, Vietnam, ranks 2nd. The last time the Philippines was a leader in the coffee industry was when we were still under Spanish control — we were the 4" biggest exporter of coffee beans in 1880. | This bill seeks to revitalize our coffee industry, especially when it comes to export, by creating the National Coffee Board that will take charge of developing programs and instituting industry-wide improvements that would benefit farmers, processors, traders, consumers, and other industry partners. | https://docs.congress.hrep.online/legisdocs/basic_19/HB03552.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 1796 | 2022 | 19th | An Act Establishing A National Program For The Coffee Industry Providing Funds Therefor And For Other Purposes | Being situated in the "Coffee Belt"—or a band around the equator that is optimal for production of coffee—the Philippines is one of the world's biggest coffee exporters. However, market conditions over time changed when output decreased since the early 2000s despite the increasing demand for the product. Coffee is one of the most valuable commodities in the world and a cultural phenomenon that has created a USD 100 Billion industry. As it is only cultivated in the Coffee Belt, this makes it one of the most sought-after industries, especially for coffee-producing developing countries. However, our local farmers are only able to produce 25,000 MT annually while demand is more than 75,000 MT. As a result, the country imports from neighboring countries such as Vietnam and Indonesia in order to meet demand that current supply cannot fulfill. Nonetheless, the government recognized the country's opportunity to be a key player in the coffee industry and has taken actions on supporting this. Coffee is currently one of the priority sectors identified for development in the country, prompting the creation of the Philippine Coffee Industry Roadmap by the Department of Trade and Industry. | This bill aims to support the current efforts being undertaken to boost the Philippine Coffee Industry through the establishment of a National Program for the Coffee Industry with the goals of developing processing technologies, conducting research thereof, and promoting to investors. It also aims to help coffee farms by establishing proper coffee processing facilities and providing marketing and promotions for export of the commodity. This creation of a National Coffee Board will help supervise and monitor development of the Philippine Coffee Industry and help it become a world-class commodity. | https://docs.congress.hrep.online/legisdocs/basic_19/HB01796.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 6234 | 2020 | 18th | An Act Declaring The Lammin Coffee Plantation Located In The Municipality Of Piddig, Province Of Ilocos Norte, As A Tourist Destination, Providing For Its Development, And Appropriating Funds Therefor | The Lammin Coffee Plantation in Sitio Lammin, Barangay Dupitac, Municipality of Piddig, Province of Ilocos Norte, is hereby declared a tourist destination. As such, its development shall be prioritized by the Department of Tourism (DOT) and shall be subject to rules and regulations governing the development of tourist destinations. Within one (1) year from the approval of this Act, the DOT, in coordination with the concerned lcal government units and agencies of the government, shall prepared a tourism development plan involving the construction, installation, and maintenance of approriate infrastructures and facilties that enhance tourism in the area. | The bill seeks to declare the Lammin Coffee Plantation as a tourist destination and requires the DOT and its attached agencies, in coordination with DA, DPWH, DSWD, DOLE, and in consultation with the local government of Piddig, to come up with a tourism development plan for the plantation. | http://www.congress.gov.ph/legisdocs/basic_18/HB06234.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Joint Memorandum Order | Joint Memorandum Order No. 01 | 2020 | Null | Establishing the National Convergence Initiative for Sustainable Rural Development (NCI-SRD) Coordination Mechanism for Rubber, Fiber Crops, Coffee, Cacao, and Other High Value Crops | This Order shall include the following: Major programs of the NCI-SRD agencies involving rubber, fiber crops, coffee, cacao, and other high value crops but not limited to: 1. DA High Value Crops Development Program (HVCDP_ 2. DA Philippine Coconut Authority (PCA) Kaanib Program 3. DAR Support Services Program 4. DENR - Forest Management Bureau (FMB) - National Greening Program (NGP), Community-Based Forest Management (CBFM), and other related programs/projects Coordination mechanism in the following eight (8) areas: 1. agricultural production; 2. training and technical assistance; 3. research and development; 4. marketing assistance; 5. machinery, equipment, facilities, and infrastructure; 6. rural credit and insurance; 7. policy and program formulation, monitoring, and evaluation and regulatory support; and 8. registry system of farmer benificiaries | This order aims to institutionalize the convergence initiative and coordination mechanism of DA-DAR-DENR-DILG NCI-SRD agencies for rubber, fiber crops, coffee, cacao, and other high value crops. | https://www.da.gov.ph/wp-content/uploads/2020/12/jmo01_s2020.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 1271 | 2019 | 18th | An Act Establishing A National Program For The Coffee Industry Providing Funds Therefor And For Other Purposes, "Coffee Development Act of 2017" | The Department of Agriculture, in consultation with the Department of Sciecne and Technology, state universities and colleges, farmer gorups, local government units, and the private sector, shall formulate necessary programs and projects for the advancement and industry-wide development of coffee in the Philippines, as follows: 1. Organize systematic programs that could improve coffee production including the devleopment of effective production systems; 2. Promote coffee as industry to investors; 3. Provide technical assistance on planting systems and rehabilitation of farms; 4. Develop efficient and productive processing technologies for coffee beans; 5. Allow and facilitate the establishment of credit programs in government banks for coffee farmers; 6. Conduct research and other scientific studies on coffee; 7. Establish and maintain a gerplasm collection and gene bank for coffee; 8. Provide marketing and promotions of coffee for domestic and export markets; 9. Classify coffee as a high value crop; 10. Establish a coffee processing facilities for farmers and farmer's organizations. 11. Coordinate and collaborate with other government and non-government agencies involved in the development of the coffee industry. There shall also be a National Coffee Board that shall direct, supervise and monitor the development and promotion of the coffee industry. | The bill aims to support the current efforts being undertaken to boost the Philippine Coffee Industry through the establishment of a National Program for the Coffee Industry with the goals of developing processing technologies, conducting research thereof, and promoting to investors. It also aims to help coffee farms by establishing proper coffee processing facilities and providing marketing promotions for export of the commodity. | http://www.congress.gov.ph/legisdocs/basic_18/HB01271.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 3251 | 2019 | 18th | An Act Establishing A National Program For The Coffee Industry Providing Funds Therefor And For Other Purposes, "Coffee Industry Development Act" | The Department of Agriculture, in consultation with the Department of Sciecne and Technology, state universities and colleges, farmer gorups, local government units, and the private sector, shall formulate necessary programs and projects for the advancement and industry-wide development of coffee in the Philippines, as follows: 1. Organize systematic programs that could improve coffee production including the devleopment of effective production systems; 2. Promote coffee as industry to investors; 3. Provide technical assistance on planting systems and rehabilitation of farms; 4. Develop efficient and productive processing technologies for coffee beans; 5. Allow and facilitate the establishment of credit programs in government banks for coffee farmers; 6. Conduct research and other scientific studies on coffee; 7. Establish and maintain a gerplasm collection and gene bank for coffee; 8. Provide marketing and promotions of coffee for domestic and export markets; 9. Classify coffee as a high value crop; 10. Establish a coffee processing facilities for farmers and farmer's organizations. 11. Coordinate and collaborate with other government and non-government agencies involved in the development of the coffee industry. There shall also be a National Coffee Board that shall direct, supervise and monitor the development and promotion of the coffee industry. | The bill seeks to revitalize our coffee industry, especially when it comes to export, by creating the National Coffee Board that will take charge of developing programs and instituting indsutry-wide improvements that would benefit farmers, prcoessors, traders, consumers, and other industry partners. | http://www.congress.gov.ph/legisdocs/basic_18/HB03251.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 3598 | 2019 | 18th | An Act Establishing A National Program For The Coffee Industry Providing Funds Therefor And For Other Purposes, "Coffee Industry Development Act" | There shall be a National Coffee Board that shall direct, supervise and monitor the development and promotion of the coffee industry. The Board, in consultation with the Department of Sciecne and Technology, state unviersities and colleges, farmer groups, local government units, and the private sector, shall formulate necessary programs and projects for the advancement and industry-wide development of coffee in the Philippines, as follows: a. Create and maintain a coffee industry roadmap that will outline the planned programs and projects to develop the coffee industry on a national scale; b. Organize systematic programs that could improve coffee production including the devleopment of effective production systems; c. Promote the coffee industry to investors; d. Provide technical assistance on planting systems and rehabilitation of farms; e. Develop efficient and productive processing technologies for coffee beans; f. Allow and facilitate the establishment of credit programs in government banks for coffee farmers; g. Conduct reserch and other scientific studies on coffee; h. Establish and maintain a gerplasm collection and gene bank for coffee; i. Provide marketing and promotions of coffee for domestic and export markets; j. Classify coffee as a high value crop; k.. Establish a coffee processing facilities for farmers and farmer's organizations; and l. Coordinate and collaborate with other government and non-government agencies involved in the development of the coffee industry. | The bill seeks to revitalize our coffee industry, especially when it comes to export, by creating the National Coffee Board that will take charge of developing programs and instituting indsutry-wide improvements that would benefit farmers, prcoessors, traders, consumers, and other industry partners. | http://www.congress.gov.ph/legisdocs/basic_18/HB03598.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 5491 | 2017 | 17th | An Act Supporting The Needs Of Persons Afflicted With Diabetes By Requiring All Restaurants, Coffee Shops, Supermarkets, Bakeries, Confectionaries, Food And Beverage Manufacturers And Other Similar Food Establishments To Provide At Least Two (2) Kinds Of Affordable Food Items, Beverages, Cakes, Pastries, Candies, Ice Cream And Other Food Products Absolutely Free From Sugar And Any Of Its Derivatives | All restaurants, coffee shops, and bakeries shall always have at least two (2) ready food and beverage items that are suitable for healthy diets. All the establishments mentioned in this act shall likewise provide separate orcontainers for the sugar free food and beverage items that must be conspicuously seen by their customers and buyers. | The bill pursues to help contribute in the promotion of awareness of healthy diet and normal body weight by supporting the needs of persons afflicted with diabetes. | http://www.congress.gov.ph/legisdocs/basic_17/HB05491.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | Senate Bill No. 564 | 2016 | 17th | An Act Creating A Coffee Research, Development And Extension Center, Authorizing The Appropriation Of Funds Therefor, And For Other Purposes | The Coffee Research, Development and Extension Center (CoRDEC) based at the Cavite State University (CvSU, in the Municipality of Indang, Province fo Cavite is hereby established. In general, the Center shall have the following general powers and functions: a. Educate and train all stakeholders of the coffee industry; b. Conduct relevant researches, scientific stuy and feasible marketing stratgeies; c. Extend technlologies; and d. Link with international organizations and other coffee development centers in other countries. The amount of Fifty million pesos (P50,000,000.00) is hereby authorized to be appropriated from the Special ACtivities Fund of the President. | The legislation envisions the creation of a center that will have the general powers and functions in line with the research, development and extension programs of DA-BAR, DOST. DTI, NEDA, and CvSU. The Center will be in the forefront of educating and training stakeholders of the coffee industry; conduct relevant researches, scientific stufy and feasible marketing strategies; extending technologies; and creating linkages with intermational organizations and other coffee development centers in other countries. | http://legacy.senate.gov.ph/lisdata/2401820687!.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | Senate Bill No. 321 | 2016 | 17th | An Act Establishing A National Program For The Coffee Industry Providing Funds Therefor And For Other Purposes, "Coffee Development Act of 2016" | The Department of Agriculture, in consultation with the Department of Sciecne and Technology, state universities and colleges, farmer gorups, local government units, and the private sector, shall formulate necessary programs and projects for the advancement and industry-wide development of coffee in the Philippines, as follows: 1. Organize systematic programs that could improve coffee production including the devleopment of effective production systems; 2. Promote coffee as industry to investors; 3. Provide technical assistance on planting systems and rehabilitation of farms; 4. Develop efficient and productive processing technologies for coffee beans; 5. Allow and facilitate the establishment of credit programs in government banks for coffee farmers; 6. Conduct research and other scientific studies on coffee; 7. Establish and maintain a gerplasm collection and gene bank for coffee; 8. Provide marketing and promotions of coffee for domestic and export markets; 9. Classify coffee as a high value crop; 10. Establish a coffee processing facilities for farmers and farmer's organizations. 11. Coordinate and collaborate with other government and non-government agencies involved in the development of the coffee industry. There shall also be a National Coffee Board that shall direct, supervise and monitor the development and promotion of the coffee industry. | The policy aims to promote the coffee industry as an income source of farmers and increase farm productivity for sustainbale development. | http://legacy.senate.gov.ph/lisdata/2375920420!.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Resolution | Senate Resolution No. 1694 | 2015 | 16th | Resolution Directing The Proper Senate Committee To Conduct An Inquiry, In Aid Of Legislation, On The Report That Climate Change And Land Conversion Are Killing Coffee Farms In Bataan | The proper Senate committee shall conduct an inquiry, in aid of legislation, on the report that climate change and land conversion are killing coffee farms in Bataan. | The resolution aims to investigate the report of Manila Bulletin on 22 November 2015 regarding the decrease in yearly production of coffee in Orani, Bataan due to climate change and the alarming and unabated conversion of agricultural lands into resorts and other commercial establishments. | http://legacy.senate.gov.ph/lisdata/2268219397!.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 946 | 2013 | 16th | An Act Creating A Coffee Research, Development And Extension Center, Authorizing The Appropriation Of Funds Therefor, And For Other Purposes | The Coffee Research, Development and Extension Center (CoRDEC) based at the Cavite State University (CvSU, in the Municipality of Indang, Province fo Cavite is hereby established. In general, the Center shall have the following general powers and functions: a. Educate and train all stakeholders of the coffee industry; b. Conduct relevant researches, scientific stuy and feasible marketing stratgeies; c. Extend technlologies; and d. Link with international organizations and other coffee development centers in other countries. The amount of Fifty million pesos (P50,000,000.00) is hereby authorized to be appropriated from the Special ACtivities Fund of the President. | The legislation envisions the creation of a center that will have the general powers and functions in line with the research, development and extension programs of DA-BAR, DOST. DTI, NEDA, and CvSU. The Center will be in the forefront of educating and training stakeholders of the coffee industry; conduct relevant researches, scientific stufy and feasible marketing strategies; extending technologies; and creating linkages with intermational organizations and other coffee development centers in other countries. | http://www.congress.gov.ph/legisdocs/basic_16/HB00946.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Resolution | House Resolution No. 432 | 2013 | 16th | Resolution Directing The Committee On Agriculture And Food To Conduct An Inquiry, In Aid Of Legislation, On The Alleged Brewing Tension In The Formulation Of The Country's Coffee Industry Master Plan By The Relevant Line Agencies Of The Department Of Agriculture, The National Competitiveness Council And Most Importantly The Direct Producers And Processors Of The Philippine Coffee | The Committee on Agriculture and Food shall conduct an inquiry, in aid of legislation, on the alleged brewing tension in the formulation of the country's coffee industry master plan by the relevant line agencies of the department of agriculture, the national competitiveness council and most importantly the direct producers and processors of the philippine coffee. | The resolution aims to address the duplication of efforts of the Department of Agriculture and National Competitiveness Council in preparing the Philippine Coffee Industry Master Plan. | http://www.congress.gov.ph/legisdocs/basic_16/HR00432.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Resolution | Senate Resolution No. 728 | 2012 | 15th | Resolution Urging The Senate Committee On Agriculture And Food To Conduct A Study, In Aid Of Legislation, Into The Coffee Industry To Continue And Institutionalize The Coffee Modernization Program For The Robust Promotion Of Cafe Barako, Alamid, And Other Philippine Coffee Variety In The World Market | Urging the Senate Committee on Agriculture and Food to conduct a study, in aid of legislation, into the coffee industry to continue and institutionalize the coffee modernization program for the robust promotion of cafe barako, alamid, and other Philippine coffee variety in the world market. | The resolution seeks to provide continued government support to coffee production for it to become competitive in the growing international specialty coffee market. | http://legacy.senate.gov.ph/lisdata/1283710849!.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Guidelines/Strategies | Philippine National Standards for Green Coffee Beans (PNS/BAFPS 01:2012) | 2012 | Null | Philippine National Standards for Green Coffee Beans (PNS/BAFPS 01:2012) | Modifications were made on the moisture content for coffee beans, and the general requirement that coffee beans shall be free from musty, moldy and other foreign odor and taste. | This standard cancels and replaces PNS/BFPS 01:2003. It aims to aims to provide common understanding on the scope, definitions, general requirements, grade and size classifications, method of preparation, sampling, methods of test for moisture content, packaging, marking and labeling, contaminants, and hygiene of Green coffee beans. | http://spsissuances.da.gov.ph/images/DAPNS/PNS-BAFS01-2012GreenCoffeeBeans(revised).pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Resolution | Senate resolution No. 729 | 2008 | 14th | Resolution Directing The Proper Senate Committee To Conduct An Inquiry, In Aid Of Legislation, On Revitalizing The Local Coffee Industry | Directing the proper Senate committee to conduct an inquiry in aid of legislation, on revitalizing the local coffee industry. | The resolution aims to revitalize the domestic coffee industry given the consistent increase in local demand and the promising economic gains the country will reap through export profits and job creation. | http://legacy.senate.gov.ph/lisdata/91028281!.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 1545 | 2007 | 14th | An Act Creating The Philippine Coffee And Tropical Fruits Development Authority, Defining Its Powers And Functions And Appropriating Funds Therefor, "The Philippine Coffee and Tropical Fruits Development Authority Act of 2007" | The Philippine Coffee and Tropical Fruits Development Authority aims to increase the productivity of coffee and tropical fruits and improve the quality of their fruits. | The bill seeks to create the Philippine Coffee and Tropical Fruits Development Authority. | Not available | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Bill | House Bill No. 2631 | 2007 | 14th | An Act Creating The Philippine Coffee And Tropical Fruits Development Authority, Defining Its Powers And Functions And Appropriating Funds Therefor, "The Philippine Coffee and Tropical Fruits Development Authority Act of 1996" | The Philippine Coffee and Tropical Fruits Development Authority aims to increase the productivity of coffee and tropical fruits and improve the quality of their fruits. | The bill seeks to create the Philippine Coffee and Tropical Fruits Development Authority. | Not available | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Resolution | Senate Resolution No. 468 | 2006 | 13th | Resolution Directing The Proper Senate Committee To Institutionalize Proper Government Initiatives To Encourage The Growth Of The Coffee Industry And Address The Decline Of Farm Production Of Coffee In The Country | The proper Senate committee shall institutionalize proper government initiatives to encourage the growth of the coffee industry and address the decline of farm production of coffee in the country. | The resolution aims to promote the much needed developments in the coffee industry and to ensure that the country's good standing in the International Coffee Organization is maintained. | http://legacy.senate.gov.ph/lisdata/47623916!.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Executive Order | Executive Order No. 478 | 1998 | Null | Increasing The Minimum Access Volume (Mav) For Coffee Beans Under The Agricultural Tariffication Act | The Minimum Access Volume (MAV) for coffee beans in the authorized 1997 MAV of 1,060 metric tons (MT) is hereby increased to 6,060 metric tons (MT); Provided, that any unavailed balance at the end of 1998 shall not be carried over to 1999. | The executive order seeks to modify the MAV for coffee beans as indicated in the Agricultural Tarrification Act. | https://www.officialgazette.gov.ph/downloads/1998/05may/19980522-EO-0478-FVR.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx | |

| Law | Republic Act No. 7900 | 1995 | 9th | An Act To Promote The Production, Processing, Marketing, And Distribution Of High-Value Crops, Providing Funds Therefor, And For Other Purposes, "High-Value Crops Development Act of 1995" | It is hereby declared the policy of the State to accelerate the growth and development of agriculture in general, enhance productivity and incomes of farmers and the rural population, improve investment climate, competencies and efficiency of agribusiness and develop high-value crops as export crops that will significantly augment the foreign exchange earnings of the country, through an all-out promotion of the production, processing, marketing, and distribution of high-value crops in suitable areas of the country. HVCs are defined as crops other than traditional crops which include, but are not limited to: coffee and cacao, fruit crops (citrus, cashew, guyabano, papaya, mango, pineapple, strawberry, jackfruit, rambutan, durian, mangosteen, guava, lanzones, and watermelon), root crops (potato and ubi), vegetable crops (asparagus, broccoli, cabbage, celery, carrots, cauliflower, radish, tomato, bell pepper, and patola), legumes, pole sitao (snap beans and garden pea), spices and condiments (black pepper, garlic, ginger, and onion), and cutflower and ornamental foliage plants (chrysanthemum, gladiolus, anthuriums, orchids, and statice). | The Act aims to promote the production, processing, marketing, and distribution of high-value crops in suitable areas of the country. | https://www.congress.gov.ph/legisdocs/ra_09/Ra07900.pdf | Coffee | Null | Jeff | 11/22/2024 | C:\Users\trist\Documents\Formatting\Output\Coffee_2024-11-22_processed.xlsx |

Data Source: Philippine Statistics Authority. 1990-2022.

ISP for Coffee

The goal of the Coffee ISP is to increase yield of dried cherries per tree, and to improve quality of coffee products to Grade A green coffee beans and Q grade of at least 82 for cup quality.

The coffee ISP has accomplished significant S&T based interventions to address the needs of the industry and to achieve its vision of highly productive and high quality coffee. Other interventions are to provide the necessary S&T solutions for a vibrant coffee industry. The ISP will further develop technologies on quality planting materials and nursery management; soil, nutrient and water management; pest management; and postharvest technologies. During this period, decision support tools will also be developed, climate change adaptation strategies, value-added products, traceability system, and database information network.

By 2028, there should already be available quality planting materials. It is also envisioned during this period to have coffee areas as agri-tourism sites, and that there will be a real-time crop monitoring system. Deployment of soil, water, pest and postharvest technologies will be done to enhance the transfer of developed technologies. Impact assessments of developed technologies will also be done during the period.

Strategic R&D

Strategic R&D is DOST-PCAARRD’s banner program comprising all R&D activities that are intended to generate outputs geared towards maximum economic and social benefits

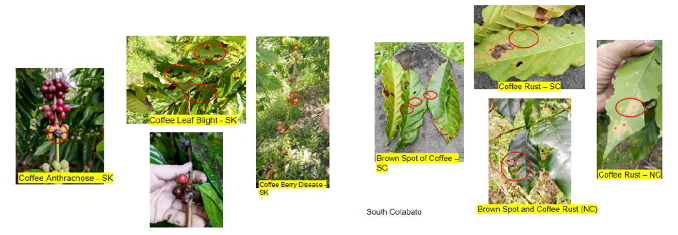

Coffee pests and diseases in South Cotabato Coffee is an important global commodity and the Philippines is a potential producer of coffee and it is...

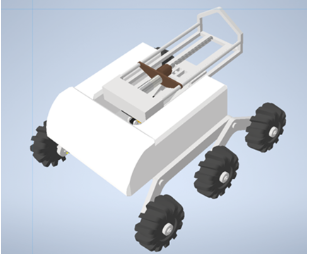

Perspective front view of initial design of UGV Presently, local farmers apply a certain amount of fertilizers without prior knowledge to the current soil nutrients...

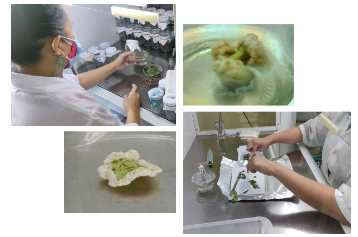

Calli induction experiment According to the International Coffee Organization (ICO), the country’s consumption of coffee constantly increasing from 862,000 bags (60 kg bag) or 51,720...

Technologies

Products, equipment, and protocols or process innovations developed to improve productivity, efficiency, quality, and profitability in the agriculture and aquatic industries, and to achieve sustainable utilization and management of natural resources

Somatic embryos ready for transfer to Plantlet Producing more good quality beans starts from planting good quality planting materials that are high yielding. To produce...

Banding patterns observed for the different coffee variety using the SSR 124577 marker The Philippine Genome Center has conducted DNA characterization of National Seed Industry...

Spectral signature collected from Cavite (each line correspond to a unique soil sample) Expansion of production area, conversion to coffee production, or replanting of old...

Technology Transfer Initiatives

Technology Transfer initatives ensure that the outputs of R&D and innovations are transformed into viable and applicable technologies that help intended users.

This study investigated the coffee value chain in the CALABARZON and developed intervention models to create a smart food value chain. Specifically, this study intended...

The project is being implemented in the three major coffee producing municipalities of Sultan Kudarat namely Sen. Ninoy Aquino, Kalamansig & Lebak. The project has...

Upscale the application of S&T interventions found to be profitable in the regular STBF that would support the raw material requirements of Technomart.

Policy Research & Advocacy

Analysis of policy concerns and advocacy of science-informed policies ensures that the AANR policy environment is conducive for S&T development and investments.

Coop for a Cup: Role of Cooperatives in Coffee Technology Adoption

As a labor-intensive country, one of the major driving forces of Philippine agricultural development is technology. Aside from cost reduction, technology enables farmers to enhance the quality of their produce, discover effective and efficient farming techniques, and ultimately address the risks and challenges inherent in agriculture. The success of a technology, however, boils down to its dissemination and adoption at the field level. It is important to recognize that technology is deemed useless if farmers will not adopt it, which is why understanding a farmer’s behavior, particularly the factors affecting their decision to adopt a certain technology, is crucial.

In 2017, PCAARRD funded a program titled, “Role of Cooperatives in Technology Adoption for Improved Production and Market Efficiency in Dairy Buffalo and Coffee”. Dr. Agham Cuevas from the University of the Philippines Los Baños led this initiative to determine how cooperatives and other rural/community-based organizations (RBOs) affect technology adoption, and production and marketing efficiency, assess their effectiveness as platforms for innovation and technology transfer in the rural areas, and provide specific recommendations on how cooperatives/RBOs can enhance technology adoption.

Impact of Coop Membership in Technology Adoption and Production and Marketing Efficiency

The study showed that cooperatives/RBOs play an important role in stimulating the adoption of technology for the enhancement of production and marketing efficiencies. In fact, studies have shown that collectively, small-holder producers share information, pool resources, and distribute costs and risks among themselves to improve yield and productivity, which would not be possible if the smallholder farmer is working alone.

Among 380 respondents, 58 percent is a member of a cooperative/RBO. Findings show that members have a greater tendency to adopt technologies (52%) relative to non-members (40%). Farmers attribute this to the prioritization of cooperative members in the provision of agricultural inputs and technical services, attendance in various training, and linkages with other stakeholders. These provisions give members greater information, resources, and support. Likewise, membership was also found to significantly affect a farmer’s ability to maximize their output given a level of inputs (technical efficiency). This suggests that cooperative members are more productive than those who are not. It was also highlighted that members have greater marketing efficiency thanks to better selling prices, greater access to buyers, and better processing activities.

Institutional constraints

- Cooperatives/RBOs identified the following institutional constraints which affect the performance of their industries:

- Lack of information/Poor access to technologies

- Inadequate equipment/facilities

- High input and transportation costs

- Poor access to credit

- Limited market access

Challenges and Recommendations

Although cooperatives serve as instruments in both industries, they are still confronted with issues such as membership delinquency, lack of participation among members, poor planning, and lack and/or mismanagement of resources. Hence, policy incentives to form and join cooperatives must be provided and associations must be strengthened through management and developmental seminars for its members. Further, greater public investment is warranted for technology diffusion, enterprise development, and establishment of facilities and processing centers near the farmers.

Reference(s):

Cuevas, A.C., Duque, J.R., Quilloy, A.M., and Mina C. (2018). Role of Cooperatives in Technology Adoption for Improved Production and Market Efficiency in Dairy Buffalo. Los Baños, Laguna, Philippines: Philippine Council for Agriculture, Aquatic and Natural Resources Research and Development – (Project Report)

Competitiveness of Philippine Robusta Coffee Industry under the ASEAN Economic

Producing coffee in the Philippines was found to be competitive under the import substitution scenario wherein producing domestically is cheaper than importing. This implies that the Philippines should focus on improving its domestic production of coffee. Based on the results, coffee yield (0.636 mt/ha) should not go down by 14% in order to maintain its import competitiveness. Results also revealed that to attain export competitiveness, yield must go up by 34% or domestic cost must decrease by 38%.

Reference(s):

Lapiña, G. F. and Andal, E. T. (2017). ASEAN Economic Community: Opportunities and Challenges for the Crops Sector. Los Baños, Laguna, Philippines: Philippine Council for Agriculture, Aquatic and Natural Resources